Featured item:

Mental Health Accessible

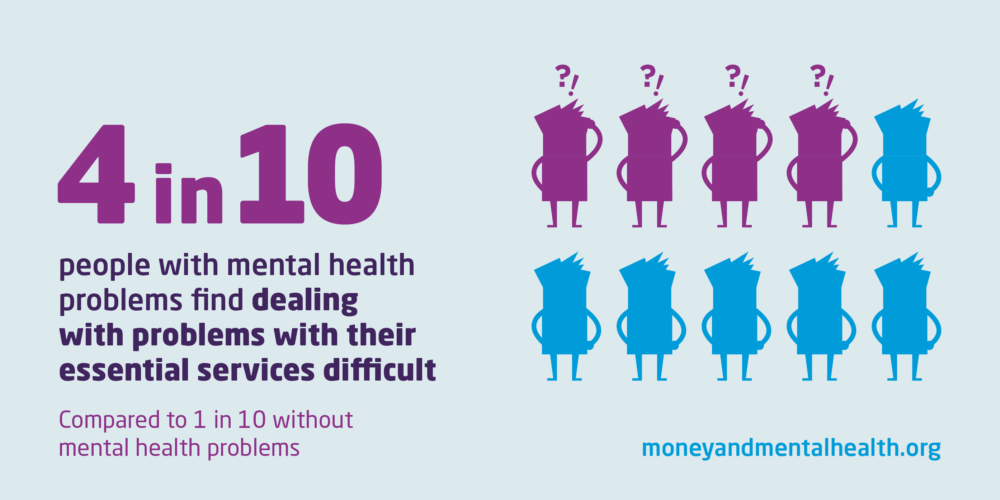

1 in 4 people experience a mental health problem each year which makes it harder for them to use services like banking, energy and broadband. It’s vital that firms take steps to make their services as accessible as possible.

That’s where our Mental Health Accessible programme comes in. We work with firms to help improve how you support customers with mental health problems – from the accessibility of your website to the tone of your debt communications.

Find out more about working with us here.

“I’ve had panic attacks and less often suicidal ideation due to the stress of trying to deal with these companies. I’ve felt very low when I ask for help and they don’t seem to want to help me.”

Expert by experience

Publications

PublicationsBanks’ role in suicide prevention

How financial services should support customers who may be at risk of suicidality.

February 05, 2026BBC

The BBC talks to Research Community member Helen about her experience with income maximisation services

January 28, 2026Income maximisation: A best practice guide for service providers

How income maximisation service providers can support their customers with mental health problems.

January 28, 2026People with mental health problems are missing out on vital income – here’s how we fix it

Lewis White, Research Officer, Money and Mental Health

January 28, 2026Anglian Water becomes first utility company to achieve ‘Mental Health Accessible’ accreditation

January 15, 2026

Money and Mental Health’s submission to Ofwat’s consultation on priority services registers standards for water companies in England and Wales

Setting out support out for Ofwat’s proposals and outlining areas where Ofwat could go further, such as introducing standards for outcomes and experience of PSR customers.

December 20, 2024