Nikki Bond, Senior Research Officer, Money and Mental Health Policy Institute

Supporting customers with fluctuating mental capacity to make financial decisions

30 January 2023

Our capacity to understand and process information fluctuates all the time; this can impact our ability to manage our finances too. A poor night’s sleep may mean our memory or concentration is reduced, and we forget to pay a bill. Or when our minds are full of long to-do lists, it can be difficult to digest complex information when comparing new financial products.

But for people who experience acute episodes of mental health problems, capacity fluctuations can extend beyond these everyday surmountable challenges. People can experience times when their symptoms are so acute that their mental capacity and ability to make a specific decision at a particular time can become impaired.

Severe mental ill health can affect people’s ability to weigh up financial decisions

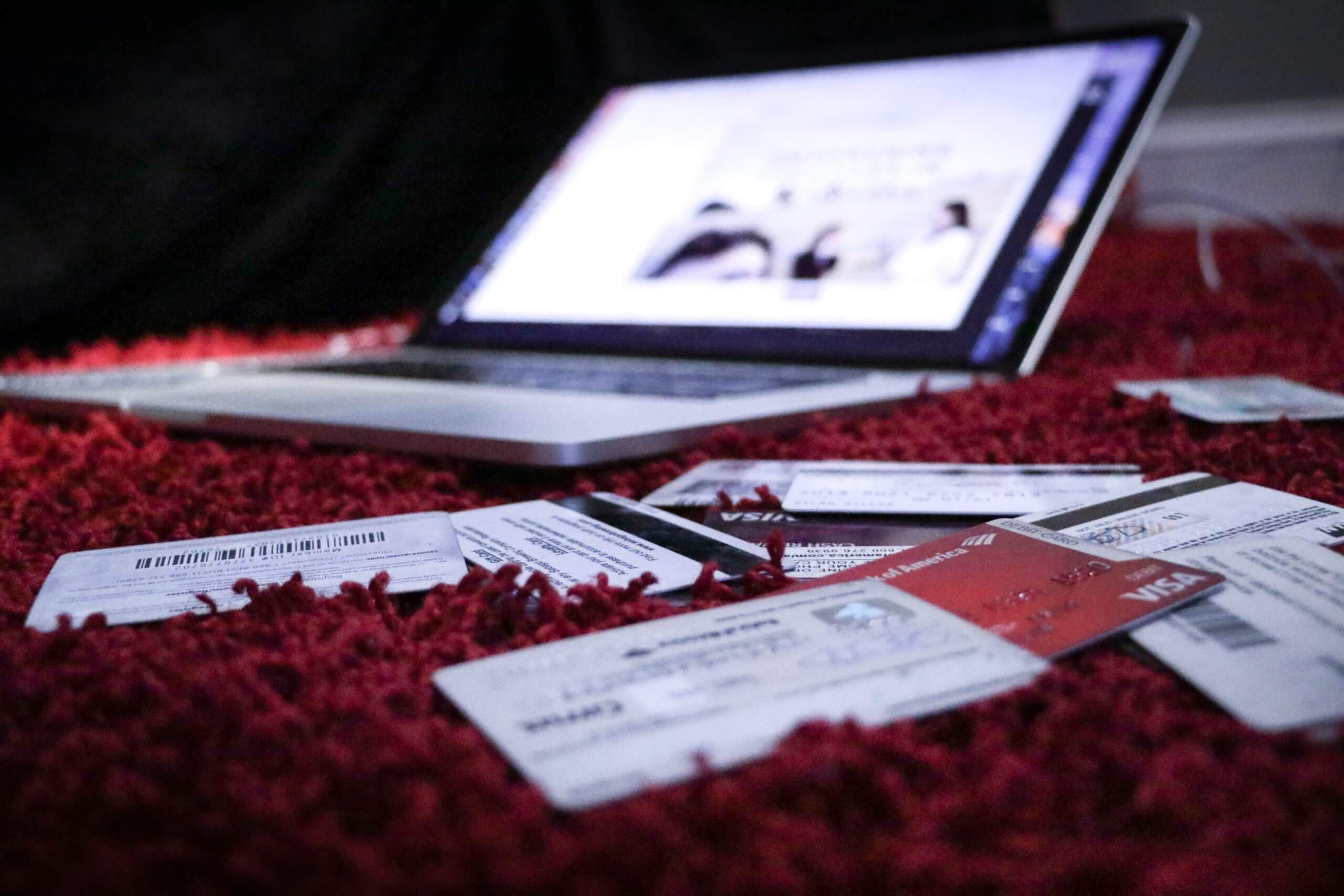

Financial service staff frequently come across customers with limitations or fluctuations in mental capacity. When I worked in financial services, I regularly encountered customers who, during a period of acute mental ill health, had incurred huge debts by impulsively giving away money, or spending vast sums on purchases they later regretted. Recovering financially from these episodes is incredibly hard. Mental health recovery when you’ve spent all of your life savings – or racked up huge debts while unwell – can be impossible.

“When I was off my medication for mental health issues I started to spend big time like getting a £2,000 loan, then applying for another four credit cards which was stupid of me but I really wasn’t thinking at the time.” Expert by experience

Severe symptoms of mental health problems, such as distorted realities, memory difficulties or increased impulsivity, can impact our ability to understand, weigh up and retain information relevant to spending or borrowing money. One in five people with mental health problems reported that during a period of poor mental health, they often or always took out credit that they otherwise wouldn’t have. Three in ten said they struggled to understand parts of the lending processes. This clearly demonstrates that people need support from financial service providers to ensure they can understand information about lending and repaying debts owed.

Supporting customers with mental capacity fluctuations

Financial services firms have a legal and regulatory responsibility to identify and support customers with mental capacity limitations. Yet all too often this is left to advisors themselves, with minimal training. This is compounded by insufficient policies and guidance around mental capacity – with more than a quarter of staff from across 18 lenders previously reporting their organisation did not have a policy on mental capacity.

Customer service staff are required to identify customers requiring support and adapt their approach to help them understand the financial decision at hand. There are multiple ways to do this: including describing terms of products in simple terms, explaining information in different ways, and providing information over several occasions rather than in one long conversation. Fortunately, two excellent guides from UK Finance and The Money Advice Trust provide greater detail that can help firms develop their own processes.

What more can financial services do?

In addition to equipping customer service staff with the skills to identify and support people with mental capacity limitations, there is more that firms can do on a system and process level. Our 2019 report, A little help from my friends, identified how people who experience fluctuations in mental capacity want to put in place financial safeguards when well, to protect themselves during times when they’re unwell. This includes systems allowing them to retain as much privacy and autonomy as possible, while also offering the ability to delegate third-party access to trusted family and friends for times when their mental capacity fluctuates.

To meet these needs, we proposed introducing tools which give people more granular levels of third-party delegation. This could include systems that allow people to:

- Share some but not all information about their accounts with a friend or family member. For example, using notifications when bills are due or spending changes

- Share information but not decision-making powers – so that a friend or family member can keep an eye on things, but the firm will go to the person first if they see something concerning, therefore protecting their independence.

Financial services firms’ concerns about data protection, financial abuse and fraud – as well as difficulties with old IT systems – mean that improving third-party access systems is continually kicked into the long grass. But people who experience fluctuations in mental capacity cannot wait for this to move up firms’ list of priorities. Financial services firms should step up now, to give people the tools they need to protect themselves from harm.