Francesca Smith, Research Officer, Money and Mental Health

Keeping suicide prevention on the agenda: Why the new government must commit to bold action

11 September 2024

Please note: this post contains information about suicide that readers may find distressing. If you’re in need of support, you can call Samaritans for free on 116 123 anytime of the day – or you can text SHOUT to 85258. For information about where to find support with your money or mental health, you can find some resources on our get help page.

- This week marks World Suicide Prevention Day, a day on which organisations all around the world raise awareness about suicide prevention.

- We know from our research that financial difficulty and suicide are linked – and we were pleased to see the government recognise that in the National Suicide Prevention Strategy published last year.

- The new government needs to ensure the Strategy receives backing and funding if it wants to fulfil its pledge to reduce the number of lives lost to suicide.

- In particular, we’re calling on the government to reinstate the suicide prevention funding for local authorities. This £57m pot for dedicated community-based support came to an end in March.

Yesterday marked World Suicide Prevention Day, and one year since we welcomed the publication of the National Suicide Prevention Strategy 2023-2028.

We were pleased to see the strategy’s focus on tackling the links between financial difficulty and suicide, and the recognition that doing so is the business of all areas of government, not just the health system.

In the past year since the strategy was published, it hasn’t exactly been a quiet time in politics. We have a new government with new priorities, and difficult challenges to face up to.

But despite this political change, the need for bold and ambitious suicide prevention action remains greater than ever. We’re calling on the new government to reaffirm its pre-election pledge to reduce the lives lost to suicide by demonstrating commitment to the strategy and ensure that suicide prevention is high on the political agenda.

Worrying signs from national data

While any life lost to suicide is an unacceptable and preventable death, figures recently published by the Office for National Statistics showed a deeply concerning 7.6% rise in national suicide rate between 2022 and 2023 – bringing it to highest level since 1999.

Although some of this will be due to changes in how data is collected, a few important trends still stand out. In particular, regional increases in the North West and North East, and rises amongst specific demographic groups such as middle-aged people, account for a large share of this rise.

There’s rarely one single factor that drives people to take their own life, and it’s hard to draw definitive conclusions from this kind of short-term data. However, analysis from Professor Louis Appleby, expert in suicide prevention, suggests that economic decline and financial insecurity may play a role among the groups most affected.

The link between financial difficulty and suicidality

There’s a clear link between financial difficulty and suicidality.

Long-term financial insecurity can wear us down, leaving us exhausted, isolated and overwhelmed. Sudden financial triggers, such as an unexpected drop in income or threatening letters from lenders, can lead to suicidal thoughts and behaviours. And, recognising the close relationship between gambling and suicidality in particular, our new Gambling Harms Action Lab will work closely with financial services firms to tackle gambling-related financial harms.

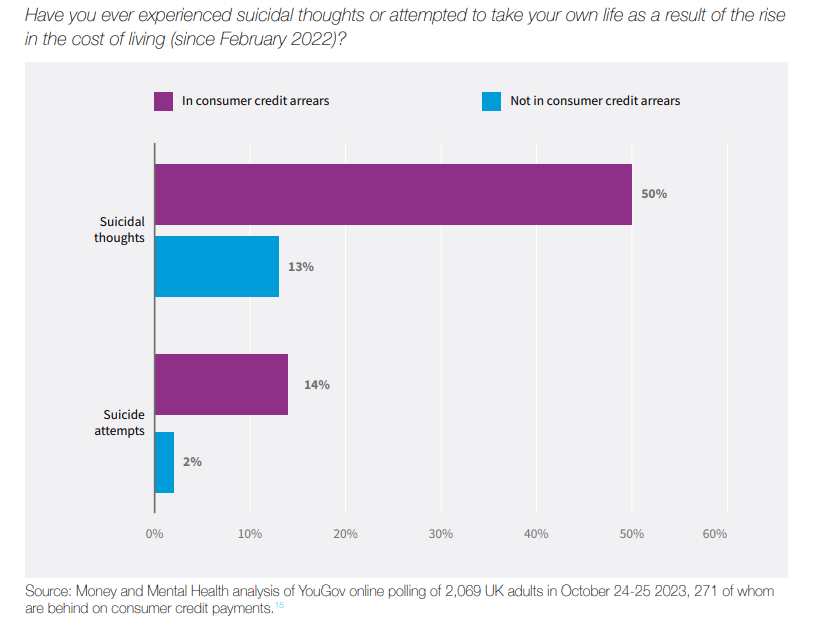

Polling commissioned by Money and Mental Health at the end of 2023 revealed how rising living costs and the growing burden of household debt have contributed to suicidality. We found that half (50%) of people who are behind on consumer credit bills have experienced suicidal thoughts as a result of the rise in the cost of living, and nearly one in seven (14%) say they have attempted suicide.

People behind on consumer credit payments are nearly four times as likely to have had suicidal thoughts than someone who is up to date on payments.

Investing in life-saving action

As we’ve raised previously, for the National Suicide Prevention Strategy to be effective, it needs the government to commit to adequate funding needed to deliver on these plans.

We know that with the Chancellor’s autumn budget on the horizon, the government faces some tough financial decisions. But when it comes to suicide prevention, there should be no expense spared in the effort to save lives.

We’re urging the government to ensure that the vital initiatives set out in the suicide prevention strategy action plan receive sufficient funding. The success of these actions hinges on the government’s willingness to prioritise and invest in this critical issue.

In particular, this should include reinstating the suicide prevention funding for local authorities – a £57m pot for dedicated community-based support which came to an end in March. Community-based support offers indispensable opportunities to intervene before it’s too late, from free suicide awareness training for local key workers to parent peer-support groups. But without dedicated funding, strained local budgets mean essential community-based suicide prevention efforts will be under threat.

The sky, not the strategy, is the limit

And with a new political chapter, there’s fresh opportunity for the government to go even further. There are a range of other actions the government can take with the aim of protecting those at risk of suicide, and particularly for the 100,000 people in debt who attempt suicide every year, including:

- Using the upcoming reforms to the Mental Health Act to ensure that people who are acutely unwell are automatically offered respite from debt through the Mental Health Crisis Breathing Space scheme.

- Ensuring that everyone using mental health services are asked about money worries and offered money advice if its needed

- Tasking the Financial Conduct Authority (FCA) with introducing new rules or guidance on how often creditors can contact people about missed payments

- Protecting Personal Independence Payment (PIP) for people with common mental health problems, and commit that no one will have their benefits cut off for struggling to navigate the move over to Universal Credit

If the new government is serious about achieving its aim of reducing the lives lost to suicide over the coming years, it will have to take bold steps that are backed by adequate resources.

If you’re in need of support with your money and/or mental health, it’s important to know that you’re not alone and help is out there. You can find information about organisations that can help here.