Toby Murray, Senior Research Officer, and Francesca Smith, Research Officer, Money and Mental Health

What’s going wrong with public sector debt collection? The findings of our new research

10 September 2024

- Our new report, In the public interest?, investigates the psychological harm done by local and national government when collecting debts.

- We find that people with mental health problems are disproportionately likely to be in debt to these creditors, and that the harm done through their debt collection processes is significant.

- We recommend that the new government intervene to slow down the speed that debt collection happens at, and put a cap on the extra fees and charges local authorities charge.

- You can support our campaign by signing our petition here.

Our new report, In the Public interest? shows the scale of harm caused by the current regime of aggressive, costly and obscure public sector (by which we mean both local and national government) debt collection processes.

Speaking to our Research Community – a group of thousands of people with lived experience of mental health problems – and stakeholders from across the sector, the story we heard is that public sector debt collection is a lose-lose situation. It disproportionately affects people on low incomes, with low financial resilience. It can cause people to withdraw, to feel strained, to be unable to think clearly. Fees, charges and unaffordable repayment plans only undermine people’s economic security and mental health further.

“I felt paralysed by my anxiety. I felt embarrassed to tell anyone or ask for help. I began worrying about losing my home. I felt like a failure because I couldn’t manage to pay my bills. I felt like it was my fault that I was unwell & couldn’t go to work. I am fed up with having to put bills before my own health.” Expert by experience

Who’s bearing the brunt?

Our analysis found that 6.2 million people in the UK are behind on payments to public sector creditors, including 3.3 million who are behind on council tax payments, 2 million who are behind on TV licence payments, with a million people behind on benefits overpayments and a million behind on unpaid tax.

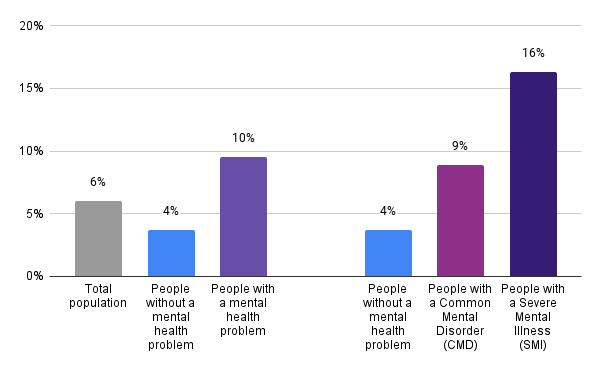

As we’ve shown time and again, experiences of mental health problems and financial difficulty are tightly linked. It wasn’t surprising, then, to find that those of us with experience of a mental health problem are twice as likely to be behind on council tax. This rises to a staggering four times as likely to be behind on council tax if you’re living with a severe mental illness such as schizophrenia or bipolar disorder.

People who have ever had a mental health problem are twice as likely to be behind on council tax

Source: Money and Mental Health analysis of the Money and Pensions Service Debt Need survey 2023. The analysis is that of the Money and Mental Health Policy Institute, and does not necessarily represent the Money and Pensions Service.

The common symptoms of these conditions, such as low self esteem and memory problems, mean people with mental health problems find it harder to navigate complex, opaque and overwhelming collections processes. People with mental health problems can become trapped in public sector debt collection systems, and are overrepresented in the later stages of debt collection as a result. Nearly three quarters (73%) of people who are in arrears and contacted by a bailiff have a mental health problem, compared to 64% in council tax arrears.

The costs of falling behind on payments

Those of us who fall behind face an assortment of punitive actions, from rapidly escalating debt collection activity to additional charges worth hundreds. From home visits by enforcement agents to deductions from our benefits or wages that push many into destitution.

As our research shows, a third of those behind on council tax could not afford any unexpected bill at all, and most (91%) could not afford an unexpected expense over £1,000, even from money they could borrow in an affordable way. This is an important number, as the average annual council tax bill is £1,668 – an amount that some may find themselves facing just three weeks after one missed payment.

The most severe consequences of being unable to pay your debts include being made bankrupt, losing your home, or even being sent to prison. The harm being done here is clear.

“Just felt left in a catch-22 situation that was hopeless. [The council’s approach to collection] exacerbated my mental health problems so much that it leaves you permanently damaged and unable to communicate and too anxious too. It’s just a relentless and pointless exercise to be understood or cared about.” Expert by experience

Panicked and powerless - this isn’t working

Rather than effectively encouraging people to engage and work to get back on track with payments, existing processes instead require people to navigate unsympathetic, complex and inflexible systems, ultimately driving them further away.

People are left feeling too panicked to reach out, too powerless to advocate for themselves, and too strained to effectively negotiate an affordable and sustainable repayment plan. Further, additional charges and fees only makes repayment or staying out of future arrears more difficult.

Reducing harm in the public sector

The full report is packed with recommendations for taking the harm out of public sector debt collection. From removing the threat of imprisonment and raising standards across the enforcement industry to overhauling rates of benefits deductions.

Crucially, we’re launching a campaign to put an end to some of the worst elements of public sector debt collection: curbing the breakneck speed of debt collection processes, and capping the hefty fees and charges added early in the debt collection process.

You can find out more about the campaign here, and you can sign our petition here. We need your support so that, together, we can change the system before next year’s council tax bills are sent round.

It’s essential we use this moment to intervene. We’re calling on the new government to put an end to this counterproductive and catastrophic regime, putting citizens at the heart of a kinder debt collection system.