Chris Lees, Senior Research Officer, Money and Mental Health

All together now - how to improve third party access in financial services

16 October 2025

- Getting support from a trusted person with your finances can be tough. Mechanisms like Power of Attorney can feel too blunt for people with mental health problems, giving away too much access and power too permanently; but alternative workarounds, like sharing cards of bank details, can be risky.

- We’re calling on banks to introduce sector-wide a set of third party tools that bridge that gap; authorised and legal but accessible and flexible.

- This should include features like carers’ cards, account notifications, and third party payment controls to provide a safe and legally protected way for people to get support with money management

- We also want the government to help, by coordinating a voluntary agreement among financial services providers to offer these third party access tools as standard.

Organising a funeral.

That’s what one member of our Research Community – a group of 5,000 people with lived experience of mental health problems or for caring for someone – compared trying to get support with their finances from a friend or family member to. That should give an indication of why this is such an important area for us at Money and Mental Health. On Tuesday, we launched our new report, If I needed someone, on this topic.

We know that people with mental health problems can really need this support when unwell. But the way that they currently can get support through authorised routes, like Power of Attorney (PoA), is not working. Instead it’s leading to people using risky workarounds, like giving someone your PIN, instead. Here I’ll set out the steps that banks, regulators and others can take to improve third party access in financial services.

Improving the current mechanisms

Apart from unauthorised workarounds, the main ways to get support from a trusted person are either through formal authorised mechanisms, such as PoA, and informal agreements with the bank, known as Third Party Mandates. However, our research found that people with mental health problems can face challenges when setting up or using these mechanisms. For example, the process can be slow or the channels that the trusted person uses to provide support can be limited or inaccessible, such as requiring someone to come into a branch.

Banks and other financial service providers can make improvements to this process by:

- Providing and clearly promoting accessible information on the different types of third party access support available and how to obtain them.

- Utilising a range of channels for customers and those that support them to register and provide support.

- Allowing trusted persons to provide more support through informal authorised mechanisms, such as Third Party Mandates, e.g. being able to make changes to payments or having their own card.

- Having a clear process for staff to follow and ensuring frontline staff are skilled and confident on third party access.

There are some limitations with what banks can do with mechanisms like PoA. Therefore we think that the Office of the Public Guardian (OPG), the body responsible for PoAs, should make it easier for people with mental health problems to apply for a PoA. For example, giving more detail on the type of support banks can facilitate.

However, people with mental health problems can feel that PoA is not designed to meet their, often fluctuating, needs. The OPG should therefore conduct a review of PoA to consider how it could be reformed to better work for people with mental problems.

Closing the gap in support

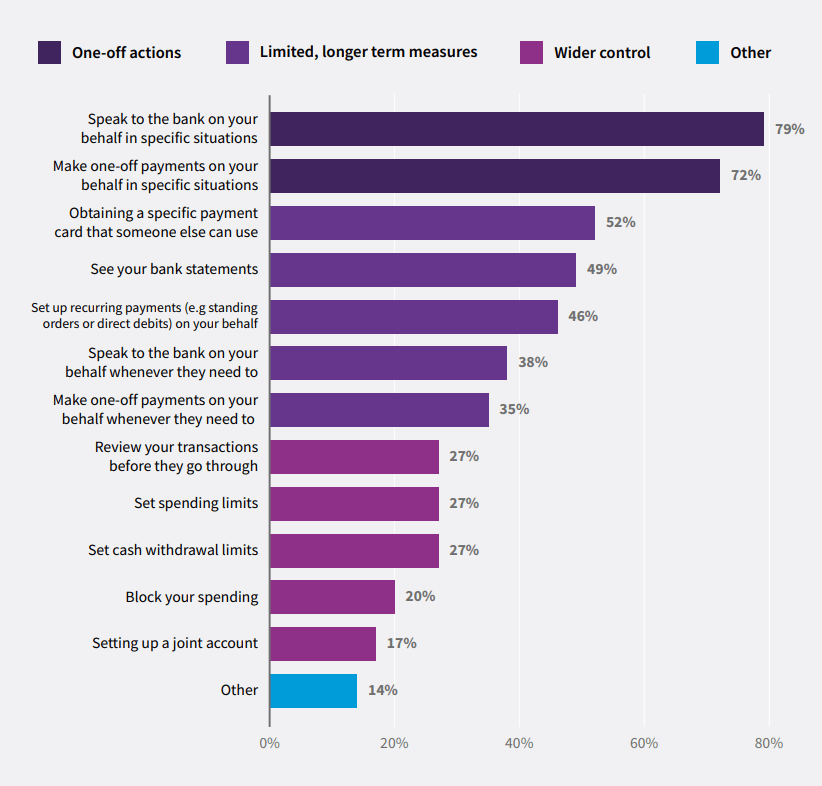

When we surveyed our Research Community we asked what support they would want from a trusted person. As the chart below shows, the most popular type was specific, one-off support, followed by ongoing but still limited support and finally a smaller group wanted to give greater control to a trusted person. This means that there is a gap between what people want and what is currently available.

There are some positive developments, however. Some banks now offer needs based mechanisms to their customers such as carers cards, transaction monitoring and payment controls. We welcome this and think these tools should be available to all customers. To achieve this goal, we are calling for financial service providers to jointly agree and aim to introduce a minimum suite of third party access tools.

To bring this about, the government and firms should make a voluntary agreement, or introduce new rules if this is not achievable. This was previously done for basic bank accounts, and would ensure progress in this case. There will still be obstacles, such as how to build in safeguards, but we think that these can be overcome through collaboration and innovation.

Working together

There are a range of organisations interested in third party access. There is currently an industry working group organised by the trade association, UK Finance. We think that this should be expanded by the Financial Conduct Authority, the regulator of financial services, to bring in more voices and views.

This group could tackle a range of issues, including those we look at in more detail in the report. For example, how banks should manage mental capacity, whether someone can understand and make a decision.

You can read the report in full here. As part of our Mental Health Accessible programme, we work closely with financial service providers to help them better support customers with mental health problems. If you are interested in working with us to improve your third party access provision, email [email protected].