Conor D’Arcy, Interim Chief Executive, Money and Mental Health

As forecasts improve, how do we fix the damage already done?

1 February 2024

- Some of the headline figures for the UK’s economic situation have improved, but millions of people are still struggling after several difficult years of rising costs.

- People with mental health problems are at the sharp end of many of these issues, whether that’s on energy bills, credit cards or paying the mortgage.

- Even if the outlook is starting to look better overall, the changes we’re calling for would make a significant difference by making support more accessible and reducing the stress of debt collection.

With the weather improving and the evenings getting a little longer, it’s easy to start looking ahead to Spring and Summer.

There’s a similar impulse when it comes to the economic backdrop. Inflation has eased off. The Bank of England didn’t cut interest rates today, but analysts are expecting that process to start in the next few months. In anticipation, many lenders have cut the rates they charge on mortgages.

All of which makes for an improved forecast for consumers who’ve been battered by the rising cost of living. But a more settled outlook shouldn’t blind us to the damage done to households over the past two years, and the urgent need to help those of us struggling with our money and mental health as a result.

Still struggling to get by

New data this week from the ONS provides an insight into the extent of those struggles. While some indicators have improved, the share of people who are having difficulty affording food, energy or housing payments remains too high. But for some groups, including those of us with symptoms of depression, the risk is even greater.

The ONS found that 61% of people experiencing moderate-to-severe depressive symptoms said they found it difficult to keep up with energy bills, compared with 35% of people with no or mild depressive symptoms.

That chimes with what we’re seeing. The relationship between having trouble making ends meet and poor mental health is reinforcing. We frequently hear about how people’s financial situation damages their mental health, as well as how symptoms of mental health problems can make it harder to earn and manage your money.

Cutting back to keep your home

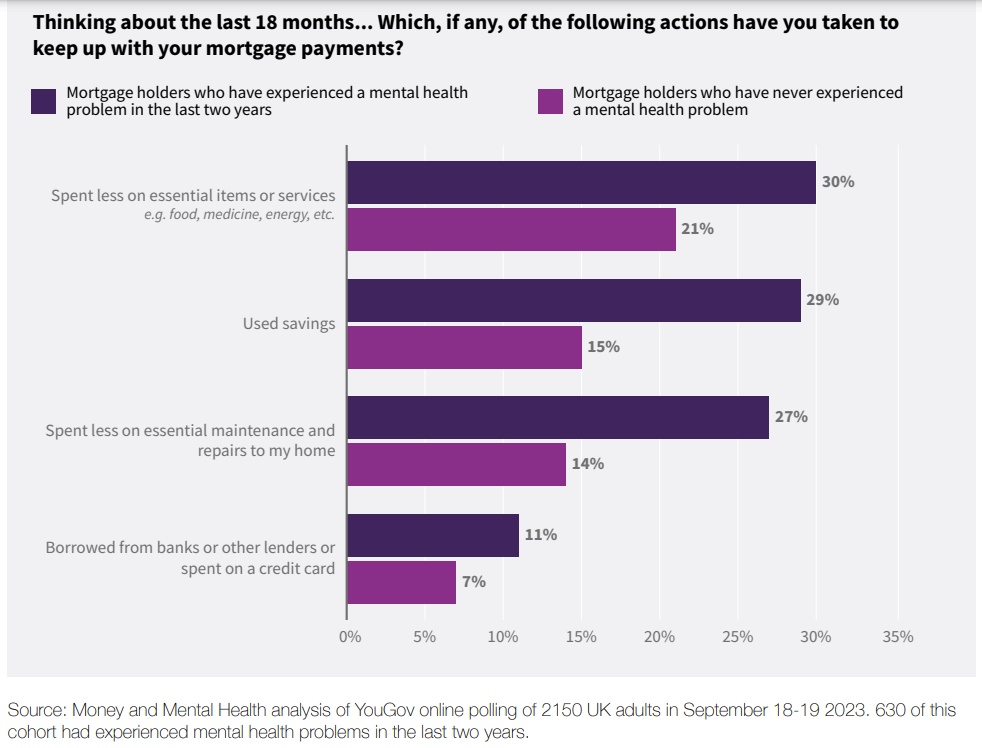

That’s a story we came across repeatedly in research we published last week, exploring mental health and mortgages. Our polling found that people with mental health problems were more likely to be struggling to keep up with mortgage payments.

People told us how they were cutting back on essentials like food and medicine in order to stay on top of their housing payments and protect the sense of security and stability their home gives them.

“The threat of losing your home, especially when unwell, is just too much to bear. A home is not just bricks and mortar to us, it is our safe place, where we can rest and recuperate.” Expert by experience

Bills, bills, bills

Housing payments aren’t the only bills people are facing though. In our report Debts and despair, which we launched in December, we found that 5.2 million people across the UK are behind on consumer credit payments like credit cards or personal loans. That’s a figure we’ve been tracking for over a year and, strikingly, that’s the highest we’ve seen it and 1.5 million higher than in November 2022.

The message from that polling and from many of the Research Community members we spoke to was that the spike in the cost of living had stretched them to their limit, financially and psychologically. Worryingly, half of people who were behind on consumer credit bills have had suicidal thoughts or feelings in the last 20 months.

With so many people under so much pressure, assuming lower inflation means everything goes back to normal would be a huge error. And thankfully, there’s lots that policymakers and firms can do.

More accessible support

When it comes to mortgages, there is already a suite of support lenders can offer. But more needs to be done to make that support accessible for people with mental health problems. That means being smart in how firms use data and looking at the overall picture of customers’ finances, not just whether they’re up to date on the mortgage.

Reaching out more consistently about what options are on the table would also help lower the barrier to getting in touch. But it’s also about the response people receive when they contact their lender looking for help. Training for customer-facing staff about how mental health problems can affect us practically and how to adjust the service they’re offering should lead to more people feeling supported and understood. For instance, that could mean communicating through the customer’s preferred channel or following up with written summaries of discussions.

The psychological toll of debt collection

Beyond mortgages, there’s plenty that other creditors could do to protect customers. One of the repeated findings in our work on the cost of living is that it’s not just the experience of being in debt that hits our mental health – it’s how the firms we’re in debt to deal with us. One element of that is the number of times creditors make contact. A barrage of calls, emails, letters and texts can leave people feeling harassed and actually make them less likely to get in touch.

“The constant calling & emailing just makes you feel worse. It makes you less inclined to want to get in touch & sort it out. Even when you tell them not to call & email they still call you everyday.” Expert by experience

We’re calling on the government and the regulator to set out a specific limit on how often a creditor can contact someone. But it’s also something firms can start themselves, assessing their communications, making smarter use of data to get a rounded view of a customer’s circumstances and making appropriate adjustments.

It may still be a while before we’re out of winter, but action now would make it easier for struggling customers to see brighter days ahead.