Toby Murray, Senior Research Officer, Money and Mental Health

We need to talk about consumer credit collection practices

14 December 2023

- Our latest report, Debts and Despair, explores the relationship between psychological harms, being in consumer credit arrears and people’s experiences of debt collection practices.

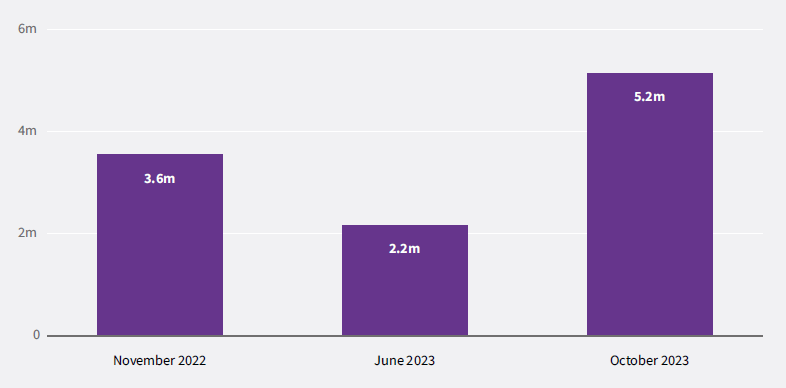

- We’ve found that 5.2m people across the UK are behind on consumer credit payments, an increase of 1.5m since November 2022.

- Millions of people feel harassed and overwhelmed by the volume of calls, messages and letters they receive from creditors about overdue payments: 1 in 4 (24%) people who have missed payments are contacted by their creditors every 1-2 days — while some people with multiple debts say they are receiving several letters, emails or calls each day.

- We want the government and the FCA to act, by setting a limit on how frequently creditors can contact people in debt.

For many of us – and in the right circumstances – credit is a powerful tool that can offer an affordable way to spread the cost of larger purchases. However, for some people, what starts as affordable credit can rapidly become unsustainable. Increasing living costs, poor health or periods out of work can all contribute to debt becoming a burden. Our latest research shows, perhaps unsurprisingly, the most common reason at the moment for falling behind with consumer credit payments is the increased cost of essentials.

This isn’t a small problem. Our report, Debts and Despair, found that 5.2 million people (10% of UK adults) have been behind on consumer credit payments in the last three months. This is an increase of about 1.5 million more people compared to the same time last year.

Figure 1: 5.2 million people are currently behind on consumer credit bills, the highest since the start of the cost of living crisis

An impending mental health crisis

This should ring alarm bells in Westminster.

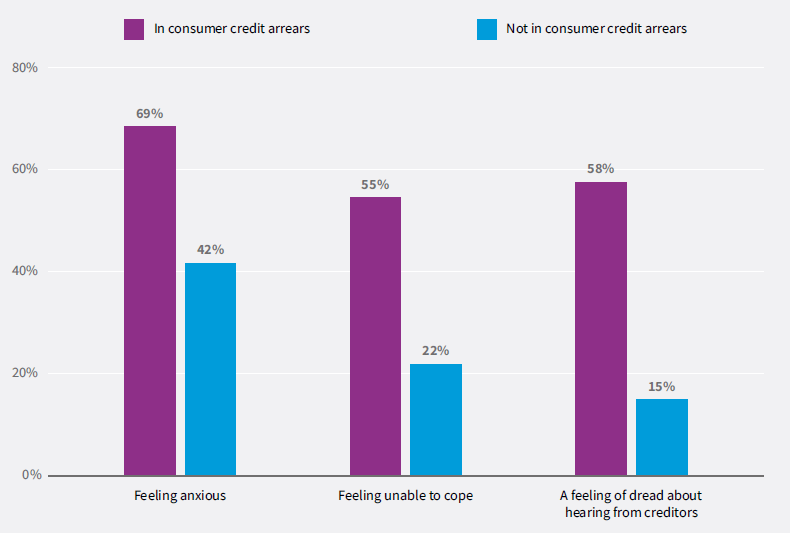

Apart from a broader financial and economic impact, there’s a serious health concern here as well. Being in arrears comes with a host of psychological harms. Our polling found that:

- Seven in ten (69%) of those behind on consumer credit payments report feeling anxious.

- Over half of people (55%) report feeling unable to cope in the last three months,

- And almost six in ten (58%) report feeling dread about hearing from creditors.

Figure 2: People who are behind on payments are more likely to be experiencing psychological harms than those who are up to date with their payments.

However, our most concerning finding is that half (50%) of people who are behind on consumer credit bills have had suicidal thoughts or feelings in the last 20 months as a result of the rising cost of living. It’s essential something is done to address this level of emotional distress.

Feeling bombarded

Our report identifies five drivers of psychological harm in debt collection practices. Here, we focus on two of those drivers, and the policy change that could go a long way to fixing this problem.

2.5 million people feel harassed by the frequency of contact from their creditors. At 49%, that’s nearly half of people in consumer credit arrears and 48% feel overwhelmed by the frequency of contact from their creditors.

“[I receive] constant letters and phone calls, after I have explained my circumstances. I dread the post and the phone ringing”. Expert by experience

We heard repeatedly from our Research Community that when they are already struggling to make ends meet for reasons out of their control, constant contact from creditors is actively unhelpful.

Turn down the volume

But hearing from one creditor is only the tip of the iceberg. With more than eight in ten (83%) of people in arrears being behind on payments for more than one consumer credit product – the communications people receive from creditors can feel like an onslaught.

At the extreme, a quarter of people in arrears (24%) are contacted by their creditors 16 times or more a month. This means a huge number of people in arrears hear from different creditors about missed payments every one to two days.

“I hated the position I knew I was in and saw no way to rectify it. Constant reminders and requests from multiple creditors just added to the feeling of hopelessness and failure.” Expert by experience

Our research found an apparent ‘tipping point’ where communications move from helpful to harmful. People who received five or more phone calls a month were much more likely to report contact had a negative impact on their mental health – 91% compared to 57% for people receiving four or less calls. A similar trend is seen across contact by letter and email.

It’s time to act

To address these challenges and reduce the psychological harm caused by debt collection practices, we make the following three recommendations:

- The government should task the FCA with an immediate review of consumer credit collection practices – to address the harm caused by high volumes of arrears communications. This review should inform the FCA’s approach to enforcing the Consumer Duty in a way that reduces harm to consumers in arrears.

- The FCA should mandate consumer credit firms to utilise credit referencing data insights to inform debt collection strategies – ensuring firms take account of the full picture of someone’s entire indebtedness to inform their collections activities.

- Consumer credit firms should ensure their collections practices align with the Consumer Duty – to do this, we recommend firms routinely and proactively collect customer information around preferred communication channels; train all collections staff to understand different mental health problems; and move beyond signposting debt advice towards warm referrals in partnership with debt advice services.

The pace of inflation may be down from its peak last year, but costs are still rising, incomes are yet to catch up and, for some, credit is filling the gap.

If we want to ensure this debt crisis doesn’t become an entrenched public health crisis, it is essential that the government, regulators and firms take action now.