Francesca Smith, Research Officer, Money and Mental Health

No place like home: our new research on mortgages and mental health

25 January 2024

- We’ve just published a new report on mortgages and mental health.

- Rising interest rates have already hit millions of people’s pockets, but mortgage holders with mental health problems are facing a double-whammy of challenges that’s putting them at greater risk of psychological and financial harm.

- Rates of arrears have risen, but we’ve also found that mortgagors with mental health problems are more likely to have taken drastic action – like cutting back on essentials or using vital savings – to keep out of mortgage arrears.

- We’re making recommendations to mortgage lenders and to the financial regulator to ensure people with mental health problems can access support.

For many of us, getting the keys to our own home is a life goal or a milestone worth celebrating.

And why not, given the stability, resilience and identity homeownership can offer?

However, a mortgage, which allows most people to buy their home, is typically the greatest debt most people will have in their lifetime. And keeping up with payments can be an immense burden. When financial difficulties mean we struggle to pay, we can quickly spiral into thoughts of losing our home, driving fear, stress and worry.

Our new research, published today, shows that this has become a reality for a growing number of mortgage holders – and especially those with mental health problems, as interest rates have soared to more than a decade-long high over the last couple of years.

Higher rates are expected to affect around 5 million households by 2026. The typical mortgage holders who will see their more affordable fixed rate deal expire between now and then will spend £240 more per month to keep the roof over their head.

This comes on top of wider rising living costs, which have already stretched budgets to the extreme, and particularly for people with mental health problems as our previous research has shown.

Headline statistics are hiding a concerning bigger picture

Yet, while rates of mortgage arrears and repossessions have risen slightly, they remain historically low. So why is there cause for concern? Well, for most people with a mortgage, it’s their top financial priority. This means that people will often do everything in their power to keep up with their mortgage, even at the cost of huge financial and psychological harm.

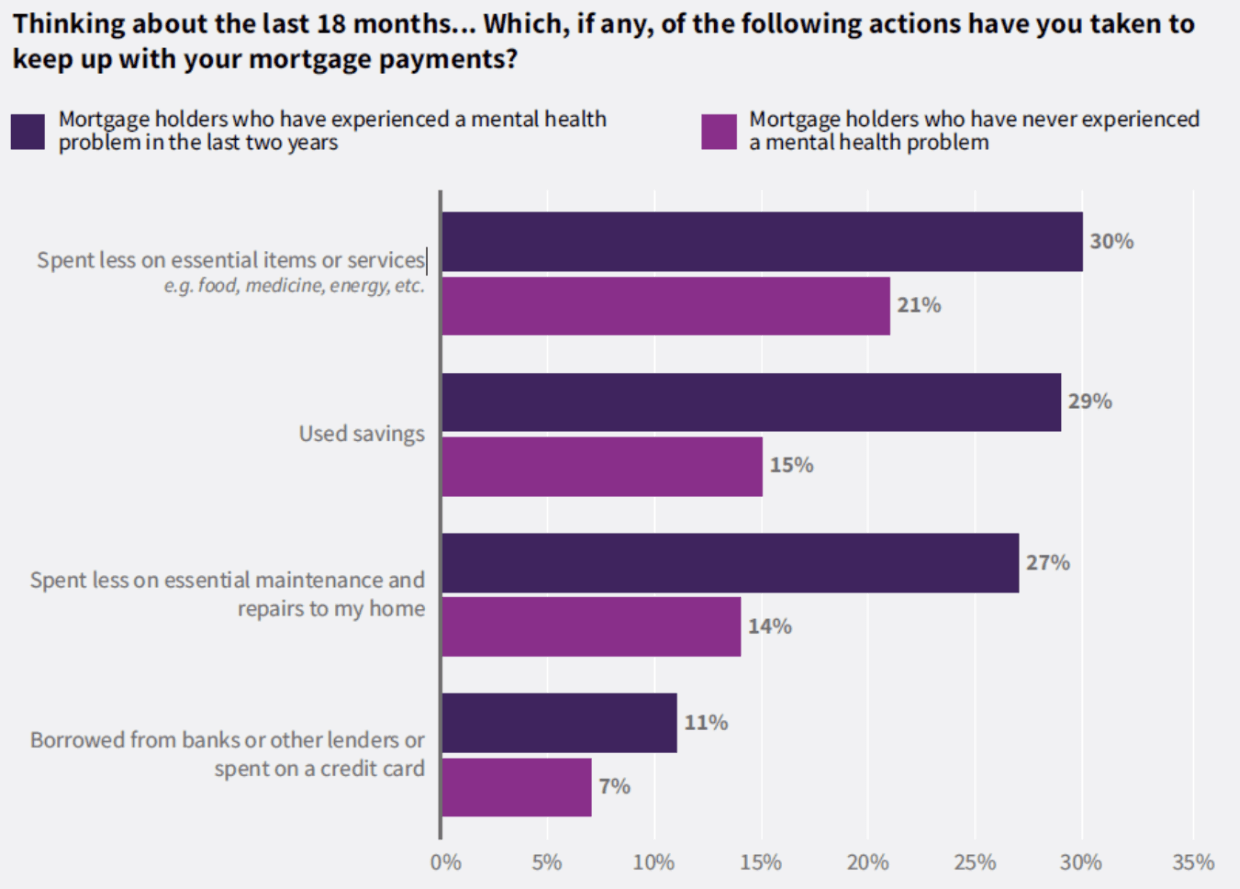

Our research finds that mortgage holders with a mental health problem are more likely to be doing just that. Half (52%) of mortgage holders with a mental health problem have taken one or more drastic actions in the past 18 months in order to stay up to date with their mortgage repayments, compared to a third (35%) of those without such conditions.

People with mental health problems are more likely to be taking action to keep up with mortgage payments

Crucially, this is not about giving up luxuries like a summer holiday or dinner at a fancy restaurant. People are cutting back on essentials like food, energy or medicine, or missing other bills in order to cover the cost of the mortgage.

Making such difficult financial decisions can be the source of huge psychological strain. That’s especially true for those of us with mental health problems, and having to cut back to the extreme can aggravate the symptoms of some conditions, as we heard from many members of our Research Community.

“Having to pay [the mortgage] in full from my income benefits leaves me unable to do anything else. I had to give up my hobby of fishing, which was the only day each week I leave the house […] I struggle to find a reason to stay alive most days while I sit in my bedroom to reduce electricity consumption and don’t have the heating on, or a TV as I can’t afford that licence now.” Expert by experience

These actions cannot be taken indefinitely. Eventually, savings dwindle, borrowing capacity is reached and essential spending is cut to the bone.

Support available isn’t reaching those who need it most

Lenders have made noteworthy efforts to increase the support available for mortgage holders during these difficult times. But for people with mental health problems, engaging with a mortgage lender can be overwhelming. Common symptoms of mental health problems – such as low self esteem, ruminating thoughts and low motivation – can make seeking help or responding to offers of support feel nearly impossible.

Our polling supported this. Two-thirds (65%) of mortgage holders with mental health problems say they would feel anxious about reaching out to their mortgage provider if they were struggling to keep up with payments. That’s compared with four in ten (41%) without mental health problems.

Lenders’ practices can make this even more challenging. For example, Research Community members told us about how a lack of clarity on the help available made them feel like reaching out wouldn’t result in any meaningful support, and how relentless and aggressive communication practices can be incredibly distressing and drive them further away from support.

“It’s a dire situation facing opening those letters and so overwhelming. At times I was getting out of bed, not sleeping, but in a different world, [I’d] get up and lay on [the] sofa and not [be] able to even bear to look out of the window… I became so scared of the letterbox and the phone, becoming more and more deeply anxious and depressed.” Expert by experience

How can we better support people with mental health problems in mortgage payment difficulty?

Mortgage holders with mental health problems are facing a worrying double-whammy of challenges that’s putting them at greater risk of psychological and financial harm and, ultimately, of losing their home. Not only are they more likely to be struggling to keep up with their mortgage payments, but they’re also less likely to be able to access and engage with support.

We’ve made a range of recommendations for mortgage lenders and their regulator, the Financial Conduct Authority, to urgently improve the accessibility and quality of support available for mortgage holders with mental health problems. An upcoming blog will provide a deep dive into some of those recommendations.

Until then, you can find more detailed information on these recommendations and others in our report here.

If you’re looking for support with your mortgage payments, you might find the Money Helper page on the support available to people facing mortgage difficulty helpful. If you’d like help with your mental health or finances more generally, please visit our Get Help page.