Nikki Bond, Head of Gambling Harms Action Lab, Money and Mental Health

“No longer living, just existing”: mental health and negative budgets

10 May 2024

- Nearly 5 million people are in a negative budget: meaning the cost of essential outgoings like housing, food and utilities exceed their household incomes.

- Being in a negative budget and having to cut back on basics like eating and heating can take a significant toll on people’s mental wellbeing.

- Many of the solutions to negative budgets require system-level change aimed at increasing incomes and reducing essential living costs.

- But there are also changes to benefits and income maximisation services that could reduce the psychological toll of negative budgets and support people out of financial difficulty.

Last month, the FCA launched its latest report on people’s experiences of the cost-of-living crisis. Their headline figures show that fewer people are struggling to manage the higher living costs than before. Still, challenges remained for some groups. The increased cost of living continues to affect the mental health of more than four in ten of us.

The unequal impact of the cost of living crisis and its effects on mental health are not new. But our research shines a light on the experiences of those at the sharp end of the crisis – those in negative budgets whose essential outgoings (such as housing, food, and utilities) exceed their income. This is a dire situation for anyone to find themselves in, but it’s a reality for nearly 5 million people.

The scale of the challenge for people with mental health problems

People with mental health problems are disproportionately represented among those struggling. Four in ten (41%) people Citizens Advice help with debt have mental health problems and a negative budget.

Against this backdrop and the government’s consideration of how to support debt advice clients with a negative budget, we surveyed our Research Community of 5,000 people with lived experience of mental health problems about their experience of negative budgets. The findings were stark.

The reality of being in a negative budget

Almost three-quarters (74%) of survey respondents had been in a negative budget in the previous 12 months. The top four reasons people reported included:

- A rise in the cost of essential goods and services, such as energy bills or food, was reported by over two-thirds (68%) of respondents

- Persistently low incomes, reported by just under half (48%) of respondents

- An unexpected cost, such as the washing machine breaking down, was reported by over one-third (36%)

- Difficulties managing money were reported by 34% of respondents.

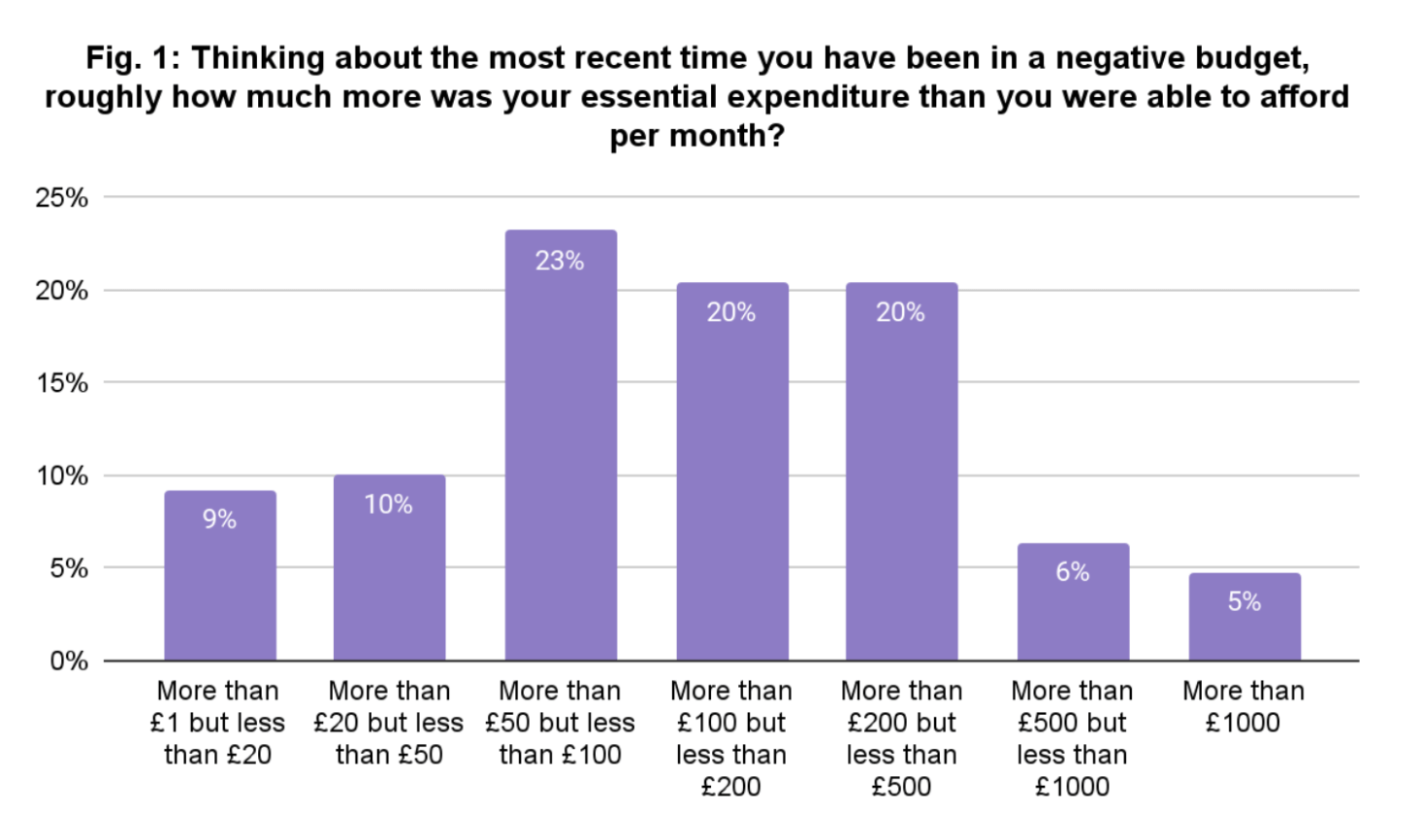

Yet there was rarely just one reason at play. Seven in ten (72%) of respondents said they were in a negative budget due to three or more factors – and over half (52%) of respondents had essential monthly expenditure that was at least £100 more than what they could afford (Figure 1).

Source: Money and Mental Health survey conducted with our Research Community. Base for this question: 250 people who have experienced a mental health problem and had a negative budget in the previous 12 months before June 2023.

These statistics make clear just how precarious people with mental health problems financial circumstances are and how impossible climbing out of a negative budget can be.

The devastating consequences of negative budgets

Not having enough money to meet essential costs can have devastating consequences. So, how do people cope when they can’t make ends meet?

Cold homes and empty stomachs:

“I can’t live in a warm house as I can’t afford to put on storage heaters. I can’t wash as much as I can’t afford to put on the immersion heater. I can’t afford decent food and can’t afford to cook it on the electric oven, even if I did have some. It makes for a depressing existence.” Expert by experience

Relying on credit to survive:

“I had to use my credit card to pay some bills. So, I had to buy less food and have flannel washes instead of showering in order to have enough money for next month to repay the minimum amount back.” Expert by experience

Missing payments on essential bills:

“We were unable to pay energy bills, so got into further debt with those. We had to make food stretch and just felt hopeless.” Expert by experience

The mental health toll

These small but daily adjustments come at a significant cost. Each has a compounding effect on people’s wellbeing, eroding mental health and exacerbating existing mental health problems.

“I have become a complete recluse, as I cannot afford to contact friends, and I’m ashamed to let anyone visit me due to my reduced hygiene and living standards. I really don’t know how much lower I can cope with.” Expert by experience

People shared how being in a negative budget, and the lengths they go to cope with this – leads to stress, feeling overwhelmed, isolation and, at times, suicidality.

“Once you are in this situation, you are always on the back foot. The inability to meet essentials is demoralising; you try to reduce costs, but there comes a point when there is no more you can save on. The gap starts to widen until it’s an abyss which is insurmountable, and you start to think, what’s the point? It’s no longer living it’s just existing.” Expert by experience

For some, the impact on their mental health means they find it hard to engage with services like debt advice to ask for help. For others, these feelings are more extreme and lead to paralysis, preventing them from accessing help.

Preventing, minimising and resolving negative budgets

There is no silver bullet to addressing these challenges. Many of the solutions to negative budgets require system-level change aimed at increasing incomes and reducing essential living costs. But beyond these systemic changes, we make two recommendations to support the increasing numbers of people in negative budgets.

1. Ensure people receive full benefit entitlements

Policy in Practice finds the total amount of unclaimed income-related benefits and social tariffs is now £22.7 billion a year, representing a 21% increase on earlier estimates. Getting these benefits to those who need them is a vital step in resolving and minimising negative budgets.

Ensuring people receive their full entitlements doesn’t have to solely be the role of overstretched debt advice and welfare rights services. Essential services firms, like financial services and energy providers, can partner with income maximisation services to provide support to those who need it. At the very least, they should include links to benefit calculators on financial hardship web pages. Staff in arrears departments should routinely point people to these tools or refer them to welfare rights services.

2. Fund debt advice services to offer income maximisation

Formal debt solutions can be out of reach for people in a negative budget, which makes income maximisation a vital tool. Yet shortcomings in how income maximisation services are funded and delivered mean the current system is failing people in need.

The Department for Work and Pensions and the Money and Pensions Service (MaPS) should sufficiently fund debt advice services to routinely offer tailored support for people to increase their incomes as standard.

The government must act

Resolving a problem as pervasive and entrenched as negative budgets is a huge challenge, but one that the government must not shy away from.

The mental health consequences of financial difficulties mean that negative budgets are not just a financial crisis, they present a mental health crisis too.