Toby Murray, Senior Research Officer, Money and Mental Health

The cost of living crisis hasn’t gone away

8 May 2024

- As inflation falls and wages start to recover, the cost of living crisis is showing signs of easing.

- However, many people are still really struggling with higher costs, and the psychological toll of the financial difficulties they’ve faced in recent years.

- It’s important that lenders and regulators step up their efforts to ensure people have access to the support they need.

- We’re calling on the Financial Conduct Authority, the financial sector’s regulator, to go further in ensuring that those of us who’ve fallen behind during the cost of living crisis are receiving vital support and, crucially, aren’t made to feel harassed by creditors.

Some things are getting better. At the time of writing, the sun is out, inflation is down, real-terms wage growth is up. These small improvements are all worth celebrating in a persistently bleak news cycle. But they all come with caveats: missed government targets, rising unemployment, unseasonable cold spells.

It’s a similar story with the FCA’s Financial Lives cost of living survey, which found that from January 2023 to January 2024, fewer people are finding it hard to manage the higher costs of living. Their figures show that 4.3m more people are “coping” with the cost of living, 3.5m fewer people feel “heavily burdened” by their bills and credit commitments, and 1.1m fewer people have fallen behind or missed a payment on one or more bill or credit commitment in the last 6 months.

While these trends are worth celebrating, there are significant caveats to these headline numbers.

Not everyone is seeing the benefit

A deeper dive into those stats shows that many across the UK aren’t experiencing these improvements:

- 14.6m people report “not coping” with the cost of living

- 7.4m feel heavily burdened by their bills or credit

- 5.5m people across the UK report falling behind on a bill or credit commitment in the last 3 months.

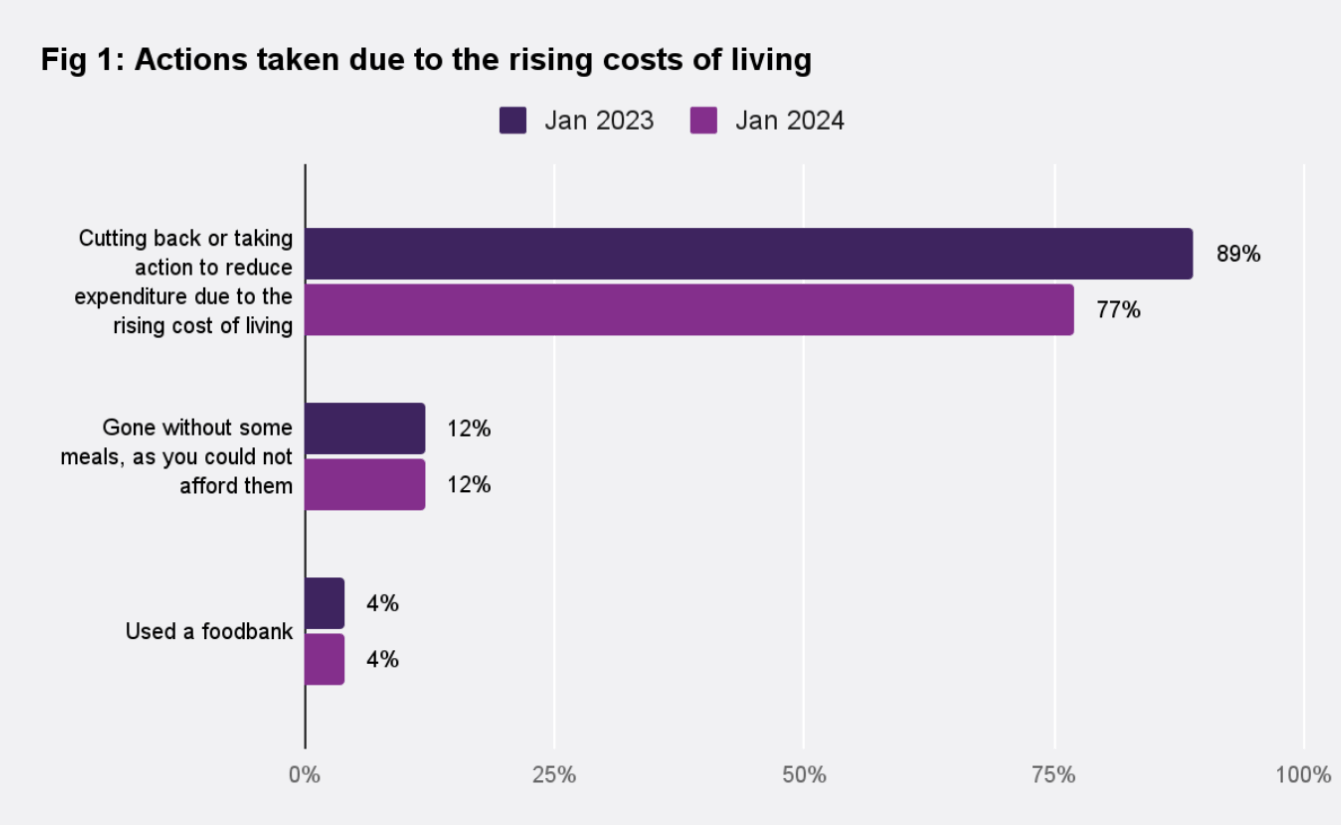

It’s certainly good news that the number of people cutting back to make ends meet has fallen by 12 percentage points, yet the overall number of people cutting back in some areas remains stubbornly high, at 77% of the UK population.

Source: Money and Mental Health analysis of Financial Lives cost of living recontact survey (Jan 2023/ Jan 2024). Base: All UK adults (2023:5,286/ 2024:3,450).

And while fewer people are cutting back on things like eating out or food shopping, the number of people in the most acute need remains constant. One in ten of us (12%) are still going without meals, and one in twenty-five (4%) are relying on a foodbank – the same rate as this time last year. This shouldn’t be the new normal.

The vicious cycle of money and mental health

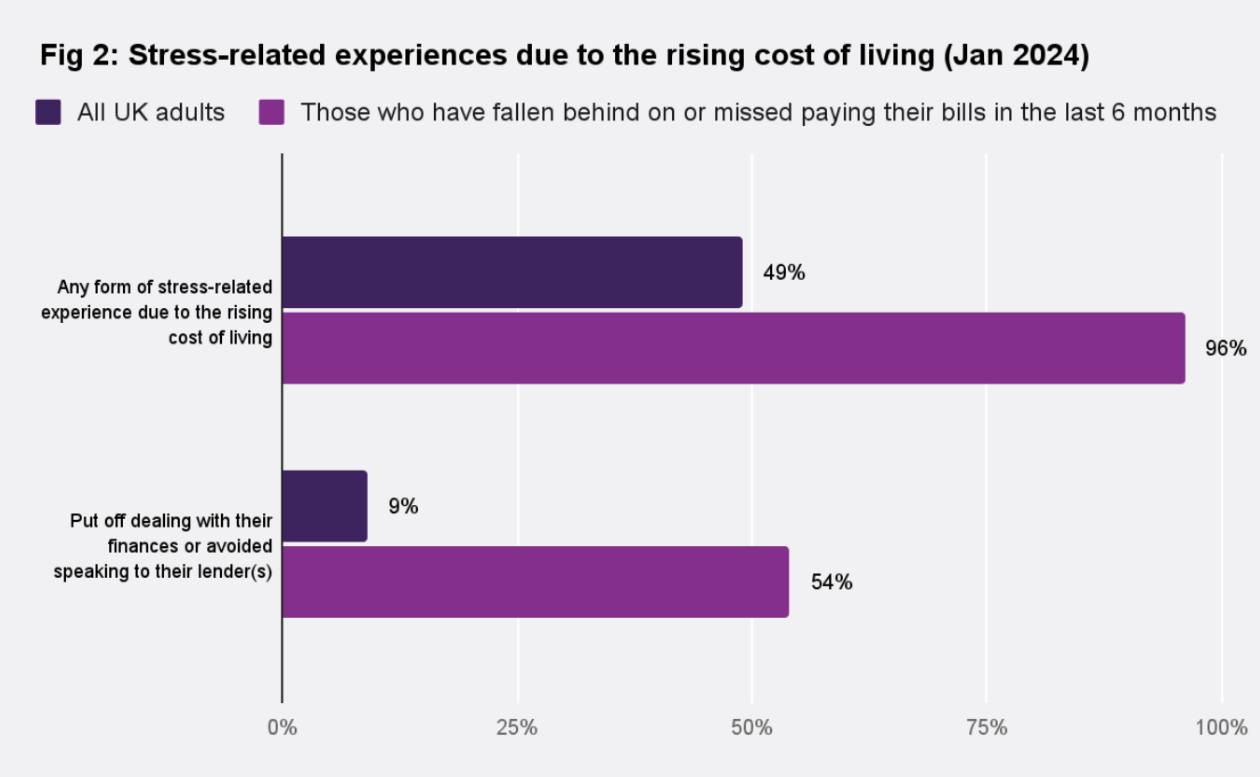

Our mental health suffers as we try to cope with the cost of living crisis. Almost everyone (96%) who had been behind on bills in the last six months said the cost of living crisis had a negative impact on their mental health. As Figure 2 shows, this is double the rate of the country as a whole.

Source: Money and Mental Health analysis of Financial Lives cost of living recontact survey (Jan 2023/ Jan 2024) Base: All UK adults (2023:5,286/ 2024:3,450) excluding ‘prefer not to say’ responses (2%/3%) / All UK adults who had missed any bills or credit commitments in any of the last 6 months (2023:361/ 2024:213) excluding ‘prefer not to say’ responses (1%/2%)

As we heard from our Research Community, a group of 5,000 people with lived experience of mental health problems, in our cost of living survey in June 2022, the worry that comes from making ends meet or missing out on essentials can drive serious psychological harm.

“I do without things all the time and skip meals or eat cheap, unhealthy but filling meals. I feel like it’s my fault we don’t have much money… The money worries have had a massive negative impact. It’s a constant worry and juggling act, making ends meet.” Expert by experience

Support and guidance

In the cost of living crisis, help is essential for those at the thin end of the wedge.

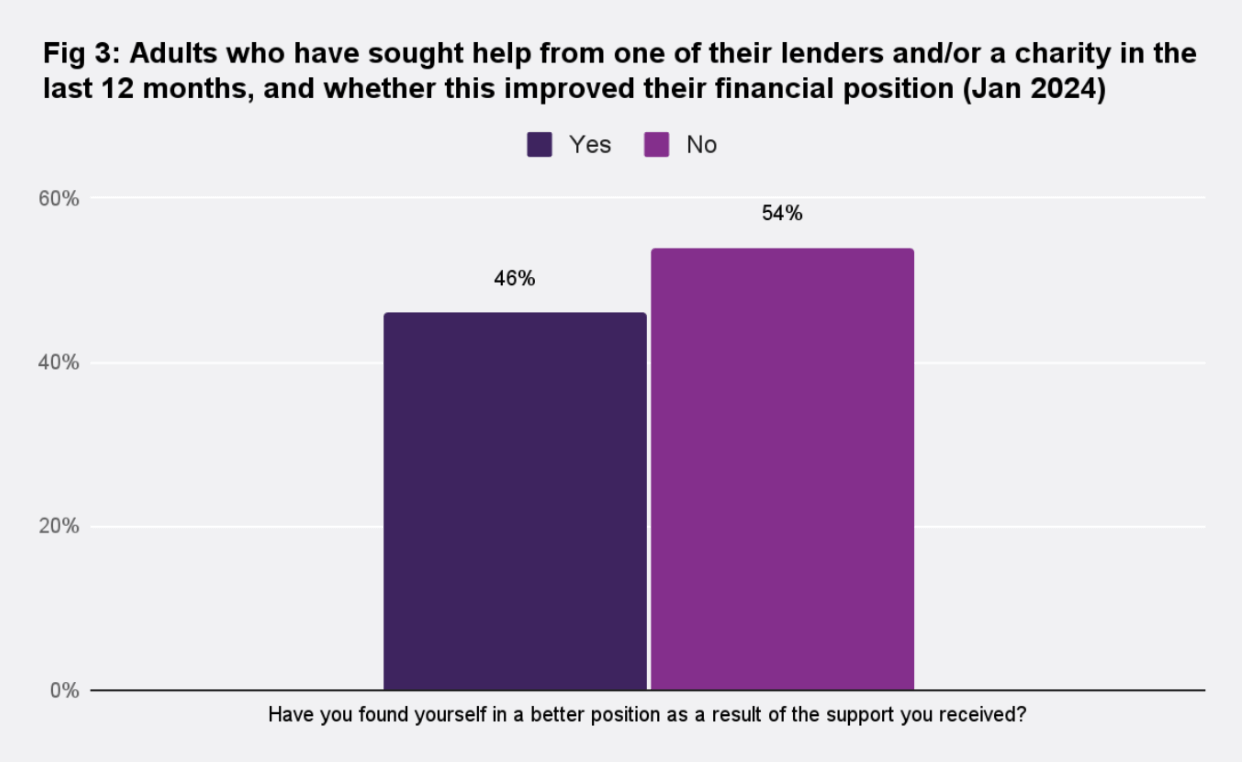

Unfortunately, more than half (54%) of people who reached out for help didn’t find themselves in a better position (Figure 3). In this context, it’s not difficult to understand why over half of us (54% – shown in Figure 2 above) who are behind on bills avoid dealing with our finances or speaking to our lenders. If we want to increase the number of people taking the often difficult leap to reach out to their creditors, we need to make sure it feels worth overcoming that barrier.

Source: Financial Lives cost of living recontact survey (Jan 2024) Base: All UK adults (2024:3,393) excluding ‘prefer not to say’ responses (3%). All adults who had received support from their lender and/or a charity (2024:100)

We also know that for those falling behind, debt collection practices can contribute to significant psychological harm. Our research revealed that 1 in 4 (24%) people who have missed payments are contacted by their creditors every 1-2 days — and some people with multiple debts receive several letters, emails or calls each day. Nearly half of people behind on payments report feeling harassed (49%) or overwhelmed (48%) by the volume of contact they receive from their creditors.

People in need of support deserve better.

Help is needed now

There’s loads that the FCA and creditors can do to help people, and a great first step is stopping the harassment that often comes with being in consumer credit arrears.

We’re calling on the FCA to implement an overall limit on the number of communications a creditor can send to someone struggling with their bills. While we were delighted to see the recent FCA and UKRN announcement to reduce harassment, the FCA can and should go much further.

The FCA should undertake a review of firms’ current collection communications practices. The data we gathered for Debts and despair on the frequency and impact of debt communications is a good indicator, but we only scratched the surface. A detailed investigation is needed to get the full picture across firms and the sector. Until we have this comprehensive understanding we can’t implement the limit that is so desperately needed.

The FCA should then work with firms, informed by credit referencing data, to ensure that customers in arrears do not get bombarded by contact and communications are supportive, encouraging people to engage rather than pushing them further away from support.

Towards a future without caveats

The FCA are right. Some things are getting better.

But that doesn’t mean we can rest on our laurels. There’s still plenty to do to make things work better for those of us with mental health problems or struggling with our bills. Ensuring that regulation meets today’s challenges is essential if we want to ensure that everyone can benefit from a tentative economic recovery.