In the run up to the Money and Mental Health techsprint follow-up event with the Financial Conduct Authority in October, we are posting a short series of #fintechfriday blogs – looking at what some of the competing teams have been up to since March.

Our second #fintechfriday blog comes from Ben, who teamed up with colleagues from IProov, Fidor and HCL…

Ben Jones, Product Owner, Consumer Digital Transformation, Lloyds Banking Group and Digital Lead with Mental Health UK

Universal design - designing fintech tools with everyone in mind

‘Positive friction’, ‘gamification’ and ‘guardian controls’ are some of the latest buzzwords used by financial services when designing fintech tools to better support customers with mental health problems. It’s no easy challenge to tackle but it’s encouraging that this has become such a hot-topic. We’ll never solve the whole challenge in one go, but through ‘test, learn, improve’ and relentless perseverance, we can start to make a real difference to people’s lives.

The golden solution

So how do we tackle this challenge? What is the tool customers want? Well to start with we’re asking the wrong question. The real question is ‘what is the outcome people living with mental health problems really want from using financial services?’ To focus on a specific tool is too narrow an approach that doesn’t consider the bigger picture.

The golden solution? ‘Universal design’. Not a one-off specific tool, but universal design embedded throughout a financial service that holistically supports all customers’ needs. Chris Fitch, Research Fellow (Personal Finance Research Centre, Bristol University) raised this at the Financial Inclusion Commission in 2014 stating ‘universal design’ was “absolutely key” to financial inclusion. And this concept of designing something with everyone in mind is no novel approach – introduced by the brilliant Selwyn Goldsmith in the 1960’s with his installation of the world’s first dropped kerb. The dropped kerb was designed with wheelchair users in mind but became beneficial to all; push chair, trolley or just walking, it is a feature now enjoyed in urban architecture worldwide!

Similarly, most people living with mental health problems don’t want to be labelled and have some packaged up ‘mental health tool’ added onto a banking app. No, they want to use their banking app for everyday needs, in a simple and stress free way that gives them the control they want.

The winning culture

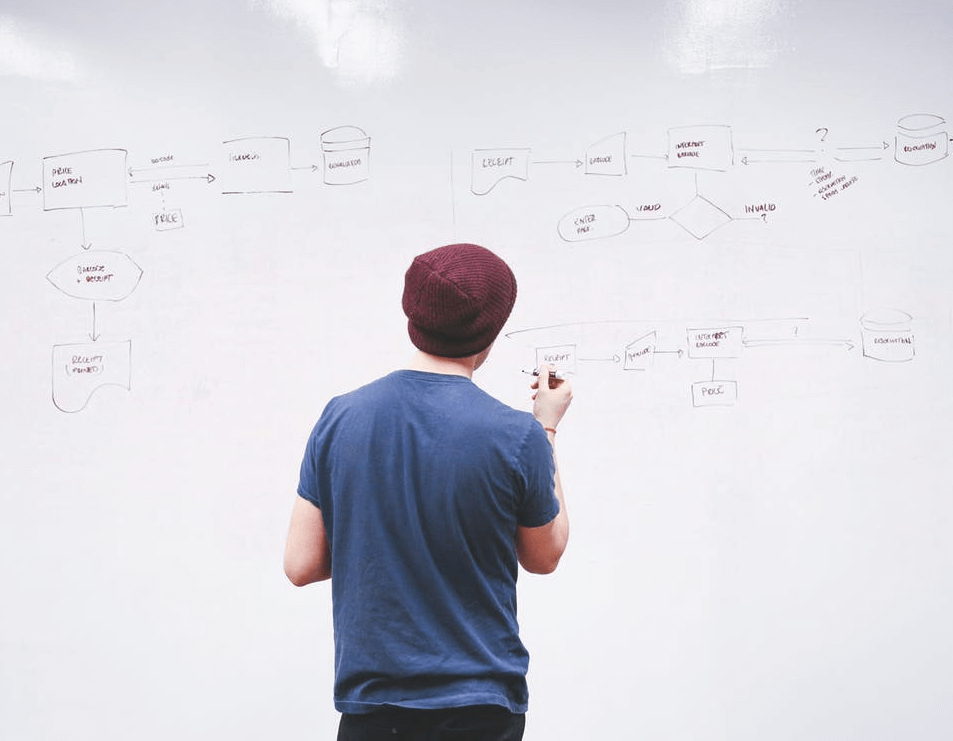

So how do we deliver universal design in financial services to support customers living with mental health problems? The answer has to lie in the people behind the process of design. It’s not the winning concept that will make waves in the field of money and mental health; it’s the winning culture.

It’s the culture of an organisation whose people see customers’ needs in the big picture; whether physical health or mental health, and designing for those needs is entwined in everything they do. It’s designing Goldsmith’s dropped kerb into fintech today. For example, whether you’re a low income or high income customer, a simple and stress free way to manage your money will be beneficial to you. A well-designed budgeting tool that gives you the transparency you need is only going to be advantageous to all.

After leading the a team in the Financial Conduct Authority and Money and Mental Health Policy Institute’s ‘Financial Service & Mental Health techsprint’ this was my biggest lesson learnt. Amongst all the great ideas, insights and learnings from the two days, the team’s greatest take away was that it’s a ‘customer first’ culture that will see any financial service effect the greatest change for money and mental health.

Beautifully simple design

The financial industry has already made great strides in implementing tech with universal design – for example, Touch ID. Touch ID removes the stress and anxiety of complex passwords and memorable information and accessing your finances at the touch of a finger; a beautifully simple design!

This is a great example of universal design in action that benefits all users. Although it was not necessarily designed specifically for those living with mental health problems, it can certainly help those who may struggle with their memory as a result of their mental health. Now by no means does this solve the bigger problem, and equally Touch ID can be a catalyst for dangerous and impulsive spending, but it is however a step in the right direction.

There is still a long way to go to ensure we keep striving towards what customers need and to break down the toxic relationship between debt and mental health. But other features (and buzzwords!) including big data, wearables, positive friction, gamification and guardian controls will all play their part in the solution.

The golden key underpinning all of these concepts will be embedding universal design as the overarching framework to benefit the user. And this will only be achieved by the organisations with the winning culture of seeing the big picture of what their customers need, and those bold enough to take the first steps in the right direction.