Nikki Bond, Head of Gambling Harms Action Lab, Money and Mental Health

Three ways firms can improve the Bank Gambling Block and other bank gambling support tools

13 August 2025

- Banks have made real progress since 2018, with most now offering a Bank Gambling Block. These tools are being used at scale, with one firm blocking over £9m of transactions in 2024.

- A BGB is one part of a broader toolkit. Many customers benefit from additional options such as opt-in gambling spend insights and cross-operator spending limits.

- Through the Gambling Harms Action Lab, we’re working with seven current account providers to refine these tools – adding meaningful friction, integrating support, and addressing gaps in how gambling transactions are identified.

Over the past six years, banks have made meaningful progress in supporting customers at risk of, or experiencing, gambling-related harms. In 2017, we recommended that firms introduce a blocking tool to enable customers to voluntarily block gambling transactions from their current account. In 2018, Starling and Monzo took up the challenge and were the first firms to introduce a Bank Gambling Block (BGB), which allowed customers to prevent most gambling on their bank cards. The rest of the sector followed suit, and as of 2024, 81% of firms had implemented a BGB.

Since its inception, BGBs have supported tens of thousands of customers. In 2024, one firm alone reported blocking over £9 million in gambling transactions. However, the job is far from done. Firms must not see the BGB as a ‘one and done’ initiative; it is just one part of a broader system of tools that banks can offer to better help customers facing gambling harms.

Offering customers a choice of gambling support tools

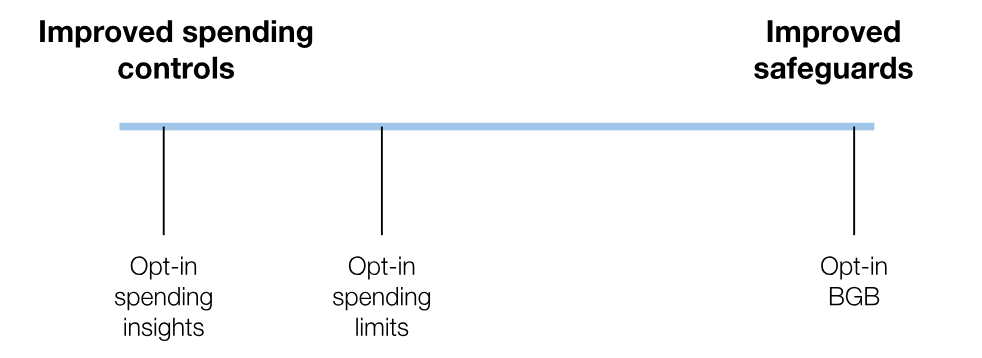

The BGB is just one of a spectrum of tools that can support customers with their gambling spending. While some customers may want to block gambling transactions entirely, others may wish to continue gambling, but with self-imposed guardrails in place. Two complimentary options banks can offer include:.

- Opt-in gambling spending insights – regular updates on weekly or monthly gambling spending, allowing customers to monitor their gambling spending.

- Opt-in gambling spending limits – customers may want to set self-imposed spending limits (e.g. £10, £20, or £30) per week or month. Banks offering this service can track spending across multiple gambling operators and block spending that exceeds customers’ own predetermined limits.

“The pattern would have been quite discernible because the money was going into various online well-known gambling sites, and my bills weren’t getting paid towards the end, and I was going overdrawn… It wouldn’t have been rocket science to look at the signs. That’s one good thing about online gambling; you can tell.” Expert by experience

Positively, current account providers have detailed information about customers’ gambling spending at their fingertips, and as part of their participation in the Gambling Harms Action Lab, the seven member firms are exploring more ways to utilise the information they have to better identify and support customers at risk of or experiencing gambling harms.

Improving bank gambling support tools: three key actions

To maximise the impact of these tools, firms must ensure they’re useful to and reach those they’re intended to serve. Over the last year, we’ve been working with our Research Community of experts by experience to understand how bank gambling support tools can be improved to meet the needs of the people they’re intended to serve. Below, we explore three key recommendations.

1) Ensure bank gambling support tools reach people who need them

- Promote tools in places people will find them – BGBs should be showcased as part of a suite of tools on firms’ gambling support pages. Presenting these options together makes it easier for customers to make informed decisions about which tool(s) to use based on their needs.

- Target communications to high gambling spend customers – Utilise the privileged insight firms have into customers’ gambling spending by proactively promoting bank gambling support tools to those who need them.

2) Make better use of existing tools

- Integrate with external support – Position information about bank gambling support tools alongside information about external sources of support, including software-based services such as Gamban, and treatment support services like TalkBanStop and NHS gambling support services.

- Design tools with meaningful friction – Friction is essential in preventing impulsive decisions. Monzo’s BGB, for example, allows customers to choose a delay ranging from 24 hours to 364 days before a customer can deactivate their BGB. Other firms should consider building similar bespoke friction into new and improved bank gambling support tools.

3) Close a crucial loophole:

- Bank gambling blocks and related tools rely heavily on the correct identification of gambling transactions. While generally effective, these tools can miss certain payments if they aren’t accurately flagged. Firms should work closely with regulators and explore new solutions, such as those offered by innovators like Gamgem, to better detect and block gambling transactions from unregulated or illicit sources.

Click here to read more about what Barclays, first direct, HSBC UK, Monzo, Nationwide, Starling Bank and Virgin Money are doing as part of their participation in the Gambling Harms Action Lab.