Helen Undy, Chief Executive, Money and Mental Health Policy Institute

PLEASE NOTE: This blog contains information on the subject of suicide that some people may find distressing.

Suicide prevention - tackling the human cost of the cost of living crisis

14 November 2022

Last month I was invited to present to an advisory group informing the government’s suicide prevention strategy. It wanted to discuss the likely impact of the cost of living crisis on suicide rates and what action should be taken now. The links between financial difficulty and suicide have been well evidenced in the past, and warning signs from the current cost of living crisis should be ringing alarm bells across government. Here’s what I covered:

What we already know about the links between suicide and financial difficulty

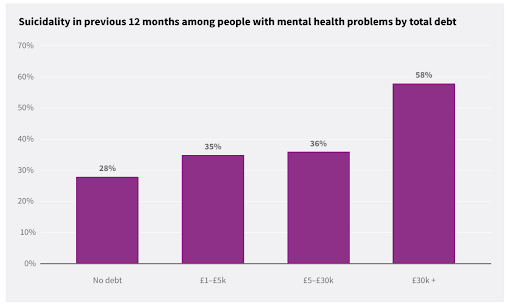

- People in problem debt are three times as likely to have thought about suicide in the past year.

This means that targeting suicide prevention interventions at people who are in financial difficulty appears to be a good way to reach those at higher risk.

- People in problem debt are still 1.8 times as likely to have thought about suicide in the last year, even after controlling for age, gender, employment and experience of traumatic events.

Suicide is complicated, and rarely the result of a single factor. But this figure suggests that financial difficulty is likely to be a key driver of this increased suicidality (rather than the difference being explained by another factor, like unemployment). Tackling financial difficulty in itself could be an effective suicide prevention intervention. It also means that we should be particularly concerned about the impact of rising levels of financial difficulty from the current crisis on suicide rates.

- 1% of people with no problem debt, or just one problem debt, attempted suicide in the past year — but this rises to 5% of people with two or more problem debts.

There is a clear relationship between increasing number of debts, and increasing suicide risk. This is likely to reflect findings from our earlier research that debt collection activity can be a sudden, short term trigger for suicidal feelings. Receiving calls, texts and letters from one creditor can be extremely hard to cope with; the compounding impact of debt collection activity from multiple creditors came through loud and clear in our research.

“To be in debt and to have people calling up to fifteen times a day, to have your voicemail full, to have the postman open your letterbox with even more debt letters with even more threats – is too much for anyone. You think your life isn’t worth living.” Expert by experience

Signs for concern from the cost of living crisis

- In May 2022 one in five UK adults (21%) said they have felt unable to cope as a result of rising prices.

We know that feeling unable to cope, or unable to see a way out, can be a risk for suicidal feelings. The very widespread nature of these feelings right across the UK population back in May should give real cause for concern. This was when most people were able to have their heating off and when interest rates and the price of essentials was lower than we’re seeing now heading into the winter months.

We were also concerned by the sheer number of survey respondents who mentioned feeling suicidal in qualitative surveys about the cost of living crisis – it’s clear that the theoretical risk that the research suggests is becoming a reality.

“I have removed any little luxuries that I used to enjoy and will now only have the heating on for three hours in the morning and three hours in the evening, despite being at home nearly all day, everyday. When I get cold, I go to bed and stay there. This does nothing for my mental health except make me feel even more depressed and suicidal.” Expert by experience

Urgent action is needed

The government is due to publish its updated Suicide Prevention Strategy soon, and it urgently needs to address the additional risk presented by the cost of living crisis. We want to see financial difficulty and problem debt threaded through the strategy and the broader 10-year mental health plan at every level from promotion, prevention, intervention, treatment and finally to crisis support. Specifically, we want to see:

- Everyone using mental health services asked about their money and offered money advice if it’s needed

- Benefits increased in line with inflation

- A commitment from DWP not to cut off anyone’s benefits as a result of the managed migration to Universal Credit

- Mental health impact assessments carried out by work coaches before benefit sanctions can be applied

- The FCA tasked with introducing new rules or guidance on the acceptable volume of creditor contact to people in debt, taking into account research on the average number of debts people have

- Routine enquiry about finances introduced at A&E for everyone who presents having attempted suicide or self harmed

- The Mental Health Breathing Space scheme broadened so that more professionals can refer in, and more people can access its support.

This winter looks set to be a very difficult one for many people, and action to tackle the potential human cost of this crisis can’t come soon enough.

If you’re in need of support with your money and/or mental health, it’s important to know that you’re not alone and help is out there. You can find information about organisations that can help here.