Merlyn Holkar, Research Officer, Money and Mental Health

The role of regulation for consumers with mental health problems

Today we’re sharing headlines from new research looking at how people with mental health problems fare when accessing essential services, such as water, energy and banking. Previous Money and Mental Health research has catalogued the range of ways that mental health problems can affect people’s financial capability. In this discussion paper, we start to explore how experiencing a mental health problem can make it harder to get a good deal in essential services markets, and how as a result, some people with mental health problems are losing out.

Our research shows that people with mental health problems are experiencing difficulties at every stage of choosing, using and paying for essential services.

Choosing essential services

Essential service markets, like energy and telecoms, are incredibly complex. There are lots of different providers, each offering a range of tariffs and pricing structures. Mental health problems can affect cognitive processes such as working memory and attention switching ability, that are used to weigh up different options, which can make searching these markets for the best deal arduous, or altogether impossible.

We surveyed more than 400 people with experience of mental health problems, and nearly three quarters (72%) told us that they find it hard to work out what is the best deal for them. An even greater majority (82%) reported that they find the thought of switching companies and shopping around exhausting.

This means that many people with mental health problems are paying more for essential services, or ending up with products that aren’t quite right for them. Not only that, but participants in our research also highlighted the human cost of these problems choosing. It can be a frustrating and demoralising experience, taking its toll on consumers’ mental health.

“All the prices and options can be overwhelming, my brain can go into meltdown”

Using essential services

Many people with mental health problems experience difficulties with certain forms of communication, such as using the telephone or opening post. But providers often don’t offer customers a range of communications options, or the ability to opt out of forms of communication that are particularly problematic.

Common problems include:

- Being distressed by marketing materials sent by providers, worrying that they are unexpected bills or emergency notifications

- Struggling to navigate telephone menus or to remember account security details

- Feeling pressurised into making decisions quickly on the phone, despite struggling with complex decision making

- Anxiety or fear related to using the telephone.

Failure to provide customers with accessible communications options can cause serious problems. People with mental health problems may miss important information from their providers, or struggle to seek support when problems develop, and being forced to use unsuitable communication channels can have a serious impact on customers’ mental health, in some cases triggering panic attacks or suicidality.

“The anxiety at having to pick up the telephone causes me so much distress that it can often take weeks to build up enough courage to make a call. Worse still, it can take even more weeks to recover from.”

Paying for essential services

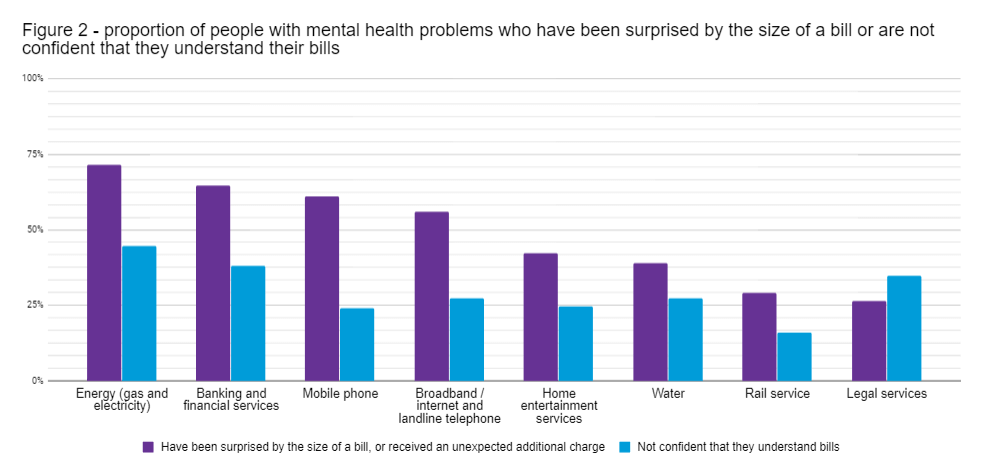

We also found that many people with mental health problems aren’t confident that they understand bills from their essential service providers, and that yet more have been surprised by the size of bills, or received unexpected additional charges from essential service providers.

Many mental health problems can affect people’s attention span and mental processing speed, which might partly explain these difficulties understanding bills. For those less able to deal with financial shocks, these problems in understanding can lead to falling behind with payments or resorting to emergency borrowing. Nationally, people with mental health problems are three times more likely to be in problem debt than those without.

“I am far from stupid; I can even make sense of tax returns, but gas, electric and water bills, not a chance.”

Next steps

Today, we’re hosting a meeting with the UK Regulators Network, the body that represents the organisations who set the rules for providers in these key industries. We’ll be sharing our findings, and discussing with the regulators what can be done to address these problems and provide better support for people with mental health problems. Following the meeting we’ll develop our ideas about what would help further, and will publish a full set of recommendations for essential service providers and the government organisations that regulate them, later in the year.