Toby Murray, Senior Research Officer, Money and Mental Health

People out of work need more support, not less

24 January 2024

- Our recent research showed that people who are unemployed are twice as likely to be behind on consumer credit debts.

- People who are out of work are also more likely to be suffering psychological distress. They are more than twice as likely as the general population to have felt anxious, unable to cope or a sense of dread about hearing from their creditors.

- It’s essential we improve support for unemployed people through the benefits system – and protect people from aggressive debt collection practices.

- We want to see a limit set on how often creditors can get in touch with people who’ve fallen behind on payments. People need more support from the welfare system during the cost of living crisis, not less.

The Prime Minister recently signalled his intention to lower taxes by cutting welfare. This should set alarm bells ringing. Despite the Autumn Statement announcement of an uprating of benefits payments in line with inflation, the UK’s benefits rates are still far below the level required for people to afford even the essentials.

Our recent report, Debts and Despair, shows that while inflation may be down, the cost of living crisis is still a looming presence for many across the country.

Our polling found that people who are currently unemployed are amongst the most exposed to the ongoing crisis, and therefore the most likely to be struggling with their debts and the psychological harms of debt collection.

Same storm, different boats

Since May 2022, Money and Mental Health have run a regular national poll to understand the impact of the Cost of Living crisis on the nation’s mental health. The focus of our latest report is on the worrying increase in consumer credit arrears and the harms done by debt collection practices across the whole population. But our polling also identified a concerning increase in the psychological and financial distress experienced by people who are currently unemployed, those out of work who are still trying to find employment.

Almost six in ten (57%) of people in this group have experienced a mental health problem in the last 2 years, compared to just a third (34%) of the population as a whole. And while the evidence of the mental health risks that come with being unemployed is well documented, we are concerned this may be a new scale of psychological harm.Our October figures show an increase of 17 percentage points from the year before (40% in November 2022). This is the biggest increase in mental ill health incidence of any group from our data.

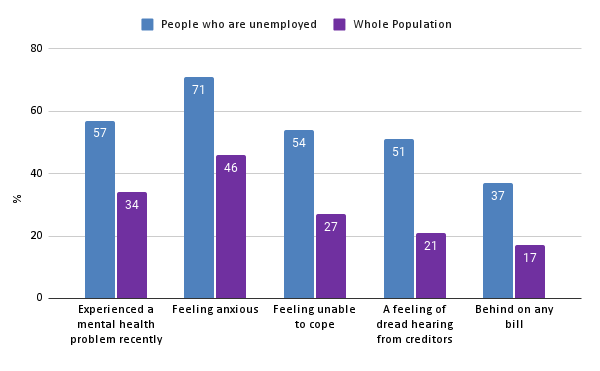

Across different measures of psychological harm, people who are unemployed fare particularly badly. As the graph below shows, they’re significantly more likely than the general population to report having felt anxious, having felt unable to cope or having a sense of dread about hearing from their creditors. Over a third (37%) have felt all three in the last three months, 2.5 times the rate of the rest of the population.

People who are unemployed are significantly more likely to have experienced psychological harms in the last three months and mental health problems in the last two years compared to the population as a whole

Source: Money and Mental Health analysis of YouGov online polling of 2,069 UK adults in October 24-25 2023, 271 of whom are behind on consumer credit payments. Full response “A feeling of dread about opening letters/post, emails or receiving phone calls from creditors”.

Our polling predates the increased benefit rates announced in the Autumn Statement, but there’s good reason to believe that these harms persist. Many will be facing expensive energy bills without government support this winter and the price of essentials like food continue to rise at much higher rates than the uprating of benefits.

As out of work households are likely to have lower levels of financial resilience, many may rely on a credit safety net to make ends meet. This is a concern, as our polling found that people who are unemployed are seven times as likely to be behind on any bill compared to those who are retired, and twice as likely to be behind on their consumer credit bills as someone in work.

“I have been neglecting and avoiding everything to do with my debts since I lost my job last September. [Experiencing debt collection activity] increased my anxiety and does every time I get contact in any form. I really find the whole situation hard to cope with.” Expert by Experience

We need better support for people who are unemployed

Years of inadequate unemployment benefits have taken a toll on the mental health of people who rely on them. As my colleague Becca argues in her recent blog, we should be making our benefits systems work better. An important first step is retracting proposals that will make it even harder for people with mental health problems to get financial support. Second is ensuring benefits rates meet the cost of living.

As we’ve seen, people who are unemployed are more likely to be on the receiving end of debt collection activity, and more likely to be experiencing mental health problems anyway. To break the cycle, it’s essential we provide people who are out of work with increased protection from the psychological harms that can come with debt collection practices.

In our report, we call for a limit on the amount of contact creditors can have with people in arrears, as high volume of arrears communications can have significant negative mental health outcomes. Given the disproportionate number of people who both are unemployed and behind on bills, progress here is essential.

“They were calling constantly. They ignored my mental health, which is one of the main reasons we were in this position as I lost overtime when I lost my job. They were aggressive on the phone. They gave the impression that they just wanted to get as much money out of us as they could. They charged us for a person to come to our home to arrange a repayment plan and then ignored it, which made me feel helpless, stupid and anxious”. Expert by Experience

Further, the extensive data that firms and Credit Referencing Agencies collect on people’s credit and spending activity is vital to addressing the level of contact or harassment someone is likely to be experiencing. We recommend that this data is used to inform data collection activity within and between firms

We also recommend creditors provide training for collections staff to understand the needs of people with mental health problems, implement a proactive approach to understanding customers communications preferences and prioritise referrals over signposting wherever possible.

For anyone stuck outside a tightening labour market, receiving insufficient benefits, the extra burden of aggressive debt collection practices can feel like a millstone. Ensuring debt collection is supportive rather than punishing is essential for minimising psychological harm.