Francesca Smith, Research Assistant, and Liam Hill, External Affairs Officer, Money and Mental Health Policy Institute

Mental health and the mortgage crisis

30 June 2023

We published research on higher mortgage costs and the impact on people with mental health problems in January 2024. In that report, we made recommendations to mortgage lenders and the Financial Conduct Authority on improving support for people facing mortgage difficulty, especially people with mental health problems.

- Climbing interest rates have seen mortgage payments rise significantly in recent months.

- There’s a looming mortgage crisis as the FCA warns that over 750,000 households could default on mortgages in the coming years.

- We’re concerned about the financial and psychological harm that could result from this mortgage crisis.

- We’re conducting research this year on mortgages, mental health and the effects of higher interest rates – and you might be able to help us.

Concerns about rising mortgage rates and rents have dominated the news in recent weeks. And that’s no surprise — the biggest regular expense that most of us see leaving our account each month is for housing. Whether that’s a mortgage or rent payment, when that amount goes up, we feel it.

That’s what’s happening to millions of us now. This year alone more than 1.4 million home-owners face significant increases in their mortgage repayments as their more affordable fixed-rate deals expire. The Financial Conduct Authority has warned that more than 750,000 households could default on mortgages in the coming years. We’re in a mortgage crisis.

An interest in interest

Why is this happening? Having recently been raised to 5%, the Bank of England’s base rate is at an almost 15-year high. The rate was around 0.5% throughout the 2010s and was 0.1% as recently as December 2021.

In addition to the 1.4 million people whose fixed-rate deals expire this year, many on a variable rate or tracker mortgage – which can go up and down with interest rates – will likely already be feeling the pain of the rate hikes.

The cost of living crisis is squeezing our finances. Our research has already shown that people with mental health problems in particular are on the sharp end of this, making soaring housing costs even more difficult to meet.

“The cost of living crisis, along with the rise in interest rates, and lack of financial housing support as a disabled mortgaged homeowner, is impacting both my physical and mental health massively.” Expert by experience

Where the heart is

Our 2018 report on housing, Where the heart is, was published at a time when the Bank of England’s interest rate hadn’t been above 0.5% in nine years. It offers nonetheless a significant insight into how difficulty paying for housing can affect our mental health.

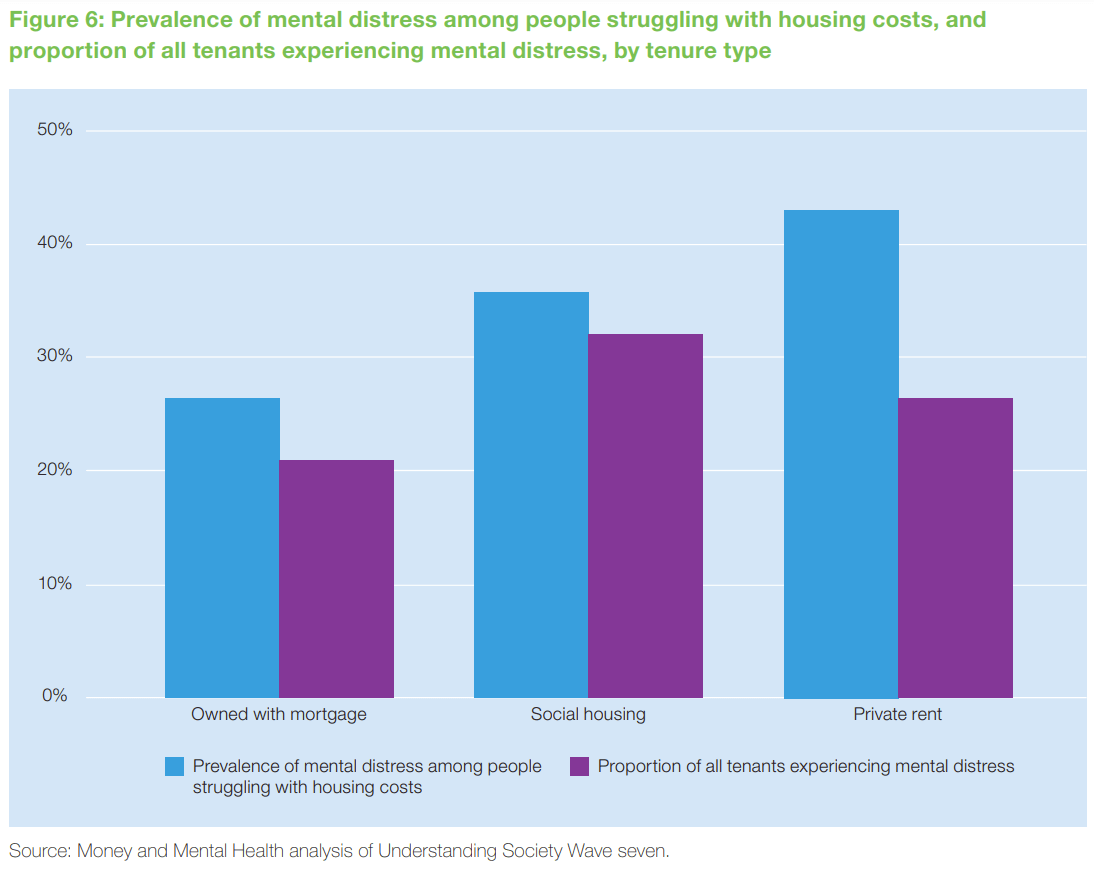

In 2015/2016, two in ten (21%) mortgage holders experienced a level of mental distress indicative of a mental health problem. That rose to over a quarter (26%) for people struggling to pay their mortgage.

Risk, cost and crisis

But that’s enough numbers for one post. Many of us have already changed how we spend our money to cope with the cost of living crisis. A big change in the cost of housing will seriously increase the strain many people are already under.

People are at a growing risk of losing their homes. At Money and Mental Health, we’re concerned about the financial and psychological harm that could result from this mortgage crisis. At the moment, too little consideration is being given to the impact of these rising costs – new or imminent – on the wellbeing of millions of people.

That is especially true of those of us with existing mental health problems. Falling behind on bills can be a major source of stress and worry – especially one as large as a mortgage payment. Mounting arrears can take a significant toll on our mental health.

For people struggling with their mental health, common symptoms such as trouble concentrating or making complex decisions can make figuring out your options when struggling to meet your mortgage payment impossible. Compounding this challenge, experiencing poor mental health can also make it harder to reach out for help – right at the moment we need it most.

Our new research project

That’s why we’re launching a new research project to better understand the psychological impact of falling behind on mortgage payments, and the particular risks for people with existing mental health problems.

We’ll be looking at how lenders can better engage with customers and proactively offer support. This might include making it easier for people to get in touch to ask for help, asking for forbearance measures or building an understanding of the emotional response people may experience when they’re at risk of losing their home – into the way the communicate with people at risk of falling behind on mortgage payments.

With more and more people rolling off fixed-rate deals in the months and years ahead, it’s vital that lenders act to reduce the stress that many people face.

How you can get involved

Our research is due to be published later this year, but we’d love to get your thoughts and ideas now.

If you want to share your experiences of how rising interest rates have affected your mental health or your finances, we’d love to hear from you. You can learn more about our Research Community here.

If your work focuses on mortgages or you’re interested in the mental health impact of struggling with payments housing and you think you might be able to help us to deepen our understanding, please get in touch with Francesca Smith at [email protected].

And if you work for an organisation that might be interested in sponsoring our research, please contact our Senior Fundraising Officer Sille Aule, [email protected].