It’s time to cap the cost of credit

Last week Money and Mental Health submitted evidence to the Financial Conduct Authority (FCA, the industry regulator) about payday loans, overdrafts and other forms of high-cost credit.

At the start of 2015, the FCA took radical action in the payday loan market, putting a price cap in place which meant no customer would ever pay back more than twice what they borrowed. Before this, some customers were rolling over loans and ending up paying back thousands more than they had borrowed. Thankfully, the reforms have worked – far fewer people now go to debt advice agencies with problems relating to payday loans, and the market has shrunk dramatically. The FCA’s new stronger regulations seem to have wiped the worst practices out.

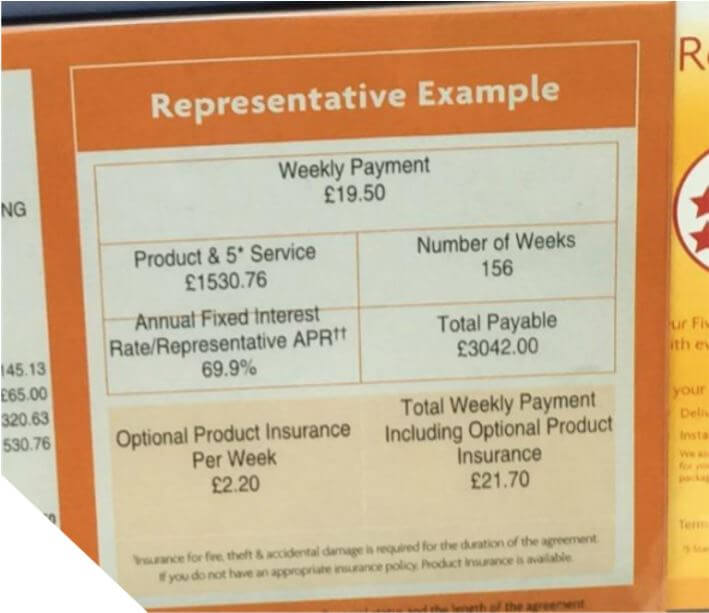

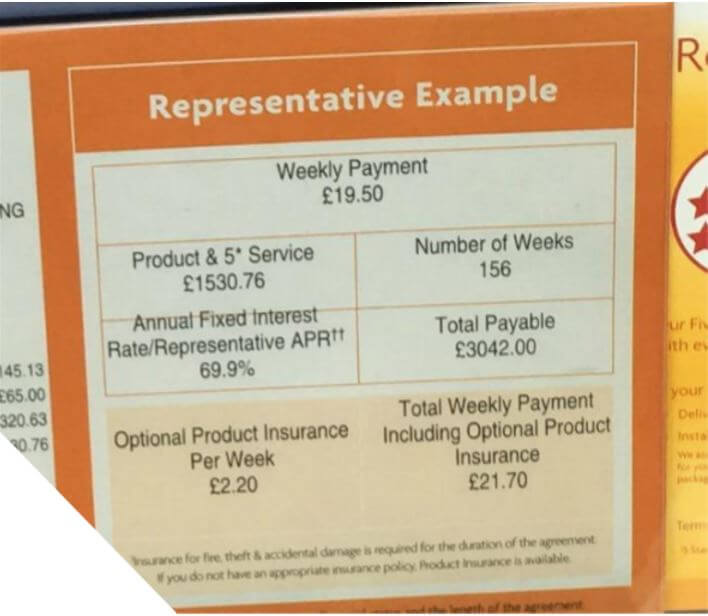

But other forms of borrowing can be just as harmful. With a recent competition inquiry finding evidence of problems in the overdraft market, a quarter of credit cards offered to higher-risk customers ending up in serious arrears within 12 months, and people using rent-to-own schemes paying two times the cost of the product they buy, it’s clear that there are serious problems in these markets which need urgent regulatory attention. So we’re pleased the FCA is expanding the scope of its review to consider these other forms of high-cost credit.

High-cost credit and mental health

“When I was very depressed I would spend money using credit cards and overdraft that I knew I would not be able to pay back – I could afford the minimum payments but the debt would gradually get bigger. I still spent it, it was very short-termist, I’d buy stuff to make me feel better or in the belief it would help me change bad habits. It got to the point of having about £12,000 in unsecured debt.”

It’s particularly important that these markets are properly regulated for the quarter of adults currently experiencing a mental health problem – 11.8 million people in total. People experiencing mental health problems are five times as likely to be behind on mail-order payments, three times as likely to be in arrears on credit card payments and twice as likely to be behind on hire-purchase or rent-to-own payments.

Our recent report Seeing through the Fog shows that mental health problems can change the way consumers make decisions about taking out credit, and increase the risk of harm. And, with a quarter of adults in the UK – 11.8 million people – experiencing these problems at any one time, it’s enormously important that the FCA takes action to prevent the worst of the harm currently occurring in high-cost credit markets.

Easy to access, hard to understand

In particular, we would like the FCA to address:

Poor price transparency. Some people experiencing mental health problems will find it harder to compare prices, due to reduced working memory or attention difficulties. Making these decisions will be even harder if, as with an overdraft, catalogue credit or rent-to-own borrowing, the cost of credit is parcelled up in a product.

Insufficient affordability checks. Some mental health problems may make consumers more impulsive, or lead to short-term memory issues which mean consumers forget undertaking transactions. This can cause particular problems in the market for secured debt, where affordability checks are often more light-touch, letting a consumer take out several types of debt at once, when they cannot afford to pay it back. Stricter affordability checks have played an important role in improving outcomes in the payday loan market.

Ease of accessing credit. For some people with mental health problems, the ability to apply for and receive credit instantaneously, or to go straight into an unarranged overdraft, can lead to unaffordable fees and serious debt problems. More than half (59%) of the 5,500 people with experience of mental health problems we spoke to last spring told us that they have sometimes taken out credit when they were unwell where they would not otherwise have done so. We are worried that, particularly when applying for credit online, there aren’t sufficient safeguards in place to help people experiencing mental health problems avoid financial difficulty.

“I spend and borrow a lot more when I begin to dip in my depression. On things we need mainly, but can’t afford. Have no concept of budget limits and often forget what I have bought until it arrives. My depression fluctuates frequently and is unpredictable, so this is a common occurrence. We have loan, overdrafts, credit cards and catalogue debts that total £10,000.“

Limiting harm while we find a solution

We’ve asked the FCA to consider introducing a price cap on other types of credit, similar to that used in the payday loans market. This would be an interim measure while they look for ways to make the market more transparent and to put in place measures to protect people experiencing mental health problems and other vulnerable consumers. It is of course, important that people can access credit when they need it. But where that credit is unaffordable, excessively expensive and difficult to understand or control, we need to make sure the cost isn’t too high.

You can find our full response to the FCA’s high-cost credit consultation here