Chris Lees, Senior Research Officer, Money and Mental Health Policy Institute

Written off? How insurance is letting people with mental health problems down

8 February 2023

Going on holiday to a new country, or buying your first home can be an exciting time! But there can also be a lot of worries whirling around your head. What if I become ill and need to go to hospital? What if I have an accident and my family can’t afford the mortgage?

Luckily there’s a financial product for that. Insurance can bring people peace of mind that they will have financial security if something goes wrong.

Unfortunately, new research we published today has found that those of us with mental health problems often aren’t able to get this financial security at a reasonable price or at all. This is having a serious impact on people’s mental health and finances at a time when everyone is worried about money.

Sky high premiums, exclusions and declines

For insurance products like travel, life and income protection, insurers will ask customers if they have a mental health problem. This is because mental health is seen as a ‘risk factor’ – which insurers use to decide whether to give someone cover and at what price.

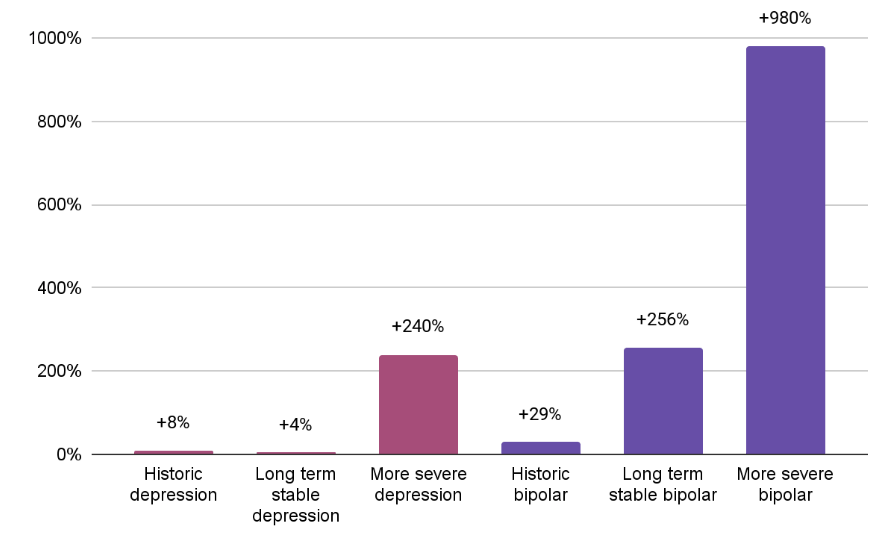

As part of our research we did a mystery-shopping exercise with 15 travel insurance providers to see what impact mental health problems have on the price and type of cover offered. We compared six mental health personas – three for depression, three for bipolar – against a persona with no medical condition. The personas differed in how severe and recent their experiences were.

We found that people with more severe depression, for example someone who had recently been to hospital, were charged on average three times more than someone with no medical condition. This rose to eleven times more for people with more severe bipolar.

Insurers can sometimes exclude mental health conditions. Five out of the 15 insurance firms included exclusions for mental health conditions, without reducing the price of the insurance product. That means people pay the same price but for less cover. Other times, insurers will decline to offer cover at all because they think someone is too likely to claim. This happened nine times in our testing and were all for someone with more severe bipolar.

The average percentage increases in price for the different personas compared to no medical condition

While our testing focused on travel insurance, members of our Research Community – a group of nearly 5,000 people with lived experience of mental health problems – had similar experiences in other products like life and income protection insurance.

“I had to declare [my mental health problem] as part of getting income protection and life insurance, in a medical interview. It was really nerve wracking and I was turned down by a number of providers due to it, even though it is well managed and has been for a number of years and does not stop me from working” Expert by experience

What is the cost?

Seeing your premium increase or be rejected by an insurer can be a difficult thing to process. There are different options people can take like trying to look for cover elsewhere or ring up the insurer, but these can all be nearly impossible if you’re struggling with your mental health. Instead people often have to pay the sky high premium or take the risk and go without insurance. But this can have a significant impact on someone’s finances and mental health.

Those of us with mental health problems are more likely to be on low incomes or in financial difficulty. Paying more for insurance cover can therefore put pressure on already stretched budgets. Meanwhile, not having insurance at all can leave people exposed to financial risk if something goes wrong. For example, paying for medical bills abroad or not being able to provide for your family if you become ill.

“The increased price is making it hard for me to manage to cover everything I have to pay out a month … [the premium] makes a significant dent in my finances” Expert by experience

Receiving a decision from an insurer can lead to people becoming angry and frustrated. While insurance can bring peace of mind, not having it can bring constant worry about what might go wrong.

“[Being quoted a higher price] made me feel stressed and victimised as I spoke to a few neighbours, one who had made multiple claims and her premiums were less than half the figures quoted to me.” Expert by experience

We also heard from Research Community members about how they felt they had been discriminated against by insurers. This was leading them to not tell an insurer about their mental health problem in the future. Although this keeps prices down, it comes with the risk of claims being rejected or losing the insurance cover.

What needs to happen?

The issues identified in our report are serious and need to be addressed. People are being exposed to financial risk and experiencing unnecessary distress during the cost of living crisis.

We’ve made a range of recommendations for insurers and their regulator, the Financial Conduct Authority, to tackle the problem. You can read a breakdown of these recommendations in our blog here, or you can read our recommendations in full in our research here.