Nikki Bond, Senior Research Officer, Money and Mental Health

Five different ways the pandemic has affected finances for people with mental health problems

22 February 2022

Most of us know the pandemic has affected people’s finances differently depending on a range of factors, and this is true for people with mental health problems too. Our report The state we’re in revealed that people with mental health problems were more likely to have struggled with debts and payments during the pandemic than those without mental health problems. But, these worrying findings mask a diverse range of experiences – which show that some people with mental health problems have fared significantly worse than others.

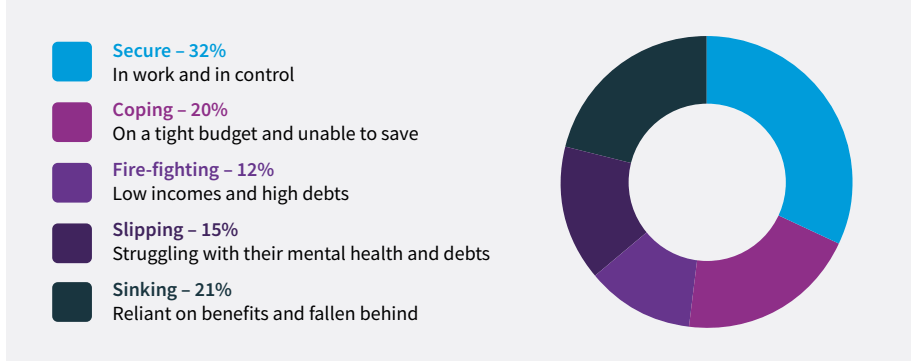

Our analysis of national polling allowed us to explore these differences in greater detail. Drawing on valuable feedback and input from the Research Community, we set out five key groups of experiences identified from our research — illustrating how money and mental health problems can compound and reinforce one another to create a range of financial experiences among people with mental health problems.

The five groups identified in our analysis

Source: Money and Mental Health analysis of Opinium. For more on how these groups were constructed, see The State We’re In.

Secure: In work and in control (32%) – People in this group were doing relatively well. They were more likely to be in work with an income higher than average among people with mental health problems. This security meant people had savings to fall back on and were up to date with their bills.

“Having a challenging full-time job has been hugely stressful at times, but the financial security it brings has helped my mental health… I know we have enough to pay the bills and meet any unexpected costs.” Expert by experience

Coping: On a tight budget and unable to save (20%) – In this group people were not in work and on a low income. Despite this, they were managing to keep up with their bills but couldn’t afford to save.

“I feel shame and upset sometimes at the financial imbalance between me and others my age. They haven’t had years of not being able to work, using up any meagre savings trying to cope. Getting back to work in a lower paid job probably and then having it all start again the next time it happens.” Expert by experience

Fire-fighting: Low incomes and high debts (12%) – Here, people were on a low income but were in work. People in this group were keeping up with their bills but had high debts and low savings.

“Once I have been paid I only have a very, very limited amount of money left after everything is paid so I can’t go anywhere or do anything.” Expert by experience

Slipping: Struggling with severe mental health problems and debts (15%) – Most of the people in this group had a severe mental illness, such as psychosis or bipolar. People in this group were in work and had incomes that were supported by benefits. Here, people had higher than average total monthly incomes, yet they’d fallen behind on bills and had high debts.

“I overspend when I am unwell… I find it harder to check my bank accounts as I don’t want to know what I’ve spent.” Expert by experience

Sinking: Reliant on benefits and fallen (21%) – The majority of people in this group were not in work, and almost all received benefits. Incomes were low. People had fallen behind on bills and had no savings to fall back on.

“[I] have had to survive on basic Universal Credit of £400 for well over two years. It’s been soul destroying and has brought me to suicide on numerous occasions” Expert by experience

Five policy changes to increase financial security

1. Help those who are secure continue to thrive by raising the level of Statutory Sick Pay – The government should raise the level of Statutory Sick Pay to ensure fluctuations in mental health and periods of sickness absence do not lead to financial difficulties.

2. Help those who are coping to build financial resilience by developing tailored employment support programmes – The Department for Work and Pensions should develop bespoke and tailored employment support programmes for those people who can work.

3. Help those who are fire-fighting to get their challenges under control by requiring all managers to have practical mental health training – Employers should require all managers to have practical mental health training as part of a plan to tackle the discrimination and ignorance people with mental health problems face at all stages of employment, from recruitment and retention to progression.

4. Help those who are slipping to get a firmer footing by mental healthcare services training staff to routinely ask people about their money worries. Mental health services should support people to get debt advice by routinely asking about the presence of money worries and integrate money advice in mental health settings so professionals have clear referral pathways to support people to resolve financial issues.

5. Help those who are sinking to get relief by increasing benefit rates – The government should raise the rates of ill-health benefits and restore the cut to Universal Credit and extend it to legacy benefits.

To find out more, you can read our full report here.