In the run up to the Money and Mental Health techsprint follow-up event with the Financial Conduct Authority in October, we are posting a short series of #fintechfriday blogs – looking at what some of the competing teams have been up to since March.

Our first #fintechfriday blog comes from Stuart, who was part of the team that won the ‘FAST’ award, for the solution that could be introduced quickest to the market…

Guest blogger: Stuart McFadden, Head of Financial Difficulties, Monzo

In the clear: using financial technology to see your money more clearly

It seems that when it comes to money, a lot of things are set up to profit from people that are not very good at managing it. Whether it’s ‘subscription traps’, overdrawn/late payment fees or auto-renewals, it can be very difficult for people to stay on top of what is going on. The reality is that people already have a lot of things in their lives to deal with, never mind having to keep track of everything they spend, read all the Terms and Conditions and remember when their renewals are due.

Perhaps you could place some of the blame firmly at the door of the customer and label them ‘lazy’, but I’ve never thought of it like that. Everybody is unique, everybody is good at some things and bad at others. And everyone has things going on in their lives that mean that sometimes it’s harder to stay on top of things than others – like in a period of poor mental health. If people weren’t bad at keeping on top of their money, you wouldn’t see business models set up to take advantage of this. Why else do so many businesses set up ‘teaser rates’ (sometimes at a loss) knowing that enough people will not bother to switch once those rates are over? This isn’t just banks, teaser rates apply to gas, electric, TV/internet packages and much, much more.

Fintech to the rescue?

So what can fintech do to help people? We are already seeing some fantastic budgeting apps and there is a move towards greater transparency around what people are spending. This isn’t just at the challenger banks, traditional banking mobile apps are also showing signs of improvement. Simply having instant push notifications when you spend will help you to notice recurring payments you might otherwise have forgotten, and because of this you might be more likely to do something about them.

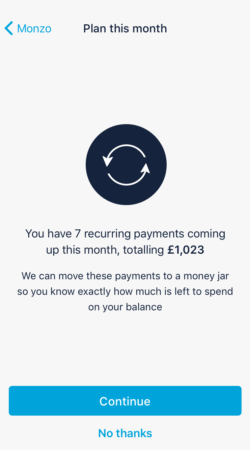

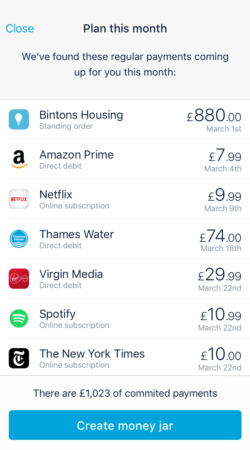

Earlier this year we took part in an FCA Financial Services and Mental Health techsprint and there were some fantastic ideas and prototypes created – specifically to help people with mental health problems to manage their money. We worked on a team with people from Aire, IProov and Shift Design to come up with an (admittedly not all that innovative) idea of ‘ring-fencing’ or ‘jam-jarring’. We wanted to build a feature over the Monzo app that allowed customers to set aside all their recurring/regular payments at the start of the month, so this money was removed from their available balance up front, and couldn’t be accidentally spent. While the feature is particularly useful for people that struggle with money, possibly exacerbated by mental health problems, we wanted to build a feature that is useful to everybody.

Keeping it simple but effective

Yes, the concept is simple and there are apps or tools that do this already, but what we felt was more unique was that it should come as a standard feature available to all customers – it requires minimal (almost no) effort to do and adds more to all the budgeting features already available with Monzo. We felt this was important as while there are already great tools out there, they almost always involve having to go out and find, download or pay for them. This usually means the people that use them already have budgeting on their radar – so are probably less likely to be the customers that really do need this feature.

Not only does ring-fencing recurring payments mean that you will get no nasty surprises at the end of month when the money goes out, but arguably more importantly, it will help customers avoid missing payments to priority creditors such as rent, mortgage payments or council tax – which can be harder to deal with or have much more severe consequences for non payment. Keeping on top of these bills could help avoid all the associated anxiety in dealing with these later on. It will also include payments to other creditors to help avoid problems down the line. The transparency should also allow customers to make decisions on what recurring payments they need to keep – and I can see this feature evolving to provide advice on how to cancel recurring payments/subscriptions for the most common payments.

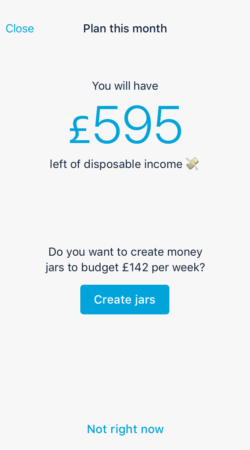

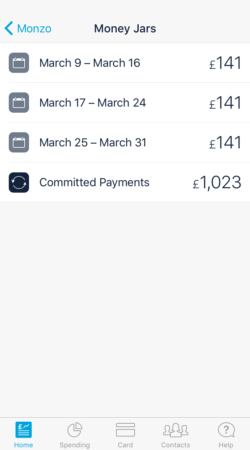

The second stage of this potential feature is where the customer can see how much money they have in reality to last them the month. This level of transparency really is lacking for most people that don’t currently proactively budget. Customers can then choose to split the monthly disposable income into weekly pots, to help manage money evenly over the month and avoid the need to borrow in order to pay for general expenditure towards the end. Of course the customer will still be able to access all their money, but to do so they will need to actively unlock the future ‘money jar’. The hope is that this tiny amount of friction will make people think twice before making any unnecessary purchases.

A look to the future

This feature is something much more suited to a current account rather than the prepaid scheme we currently offer to all our customers. Some of our customers do already have the current account and we hope to move the rest of our prepaid card customers over to the current account by the end of this year. Once this is done we will to turn our attention to implementing extra features such as this.

This is of course only one potential feature which will be refined before put into practice. But there are many other great things that Fintech can do to help customers including designing products with mental health in mind. I for one am looking forward to seeing all the new tools that will come out to help improve the way people manage their money over the next few years. As always, we will run ideas and listen to input from our community so if there is anything you think we should be doing – please let us know.