Michael, Expert by Experience

Living with gambling addiction: What can the financial services industry do to help?

6 January 2022

Most people have the view that gambling addicts are scruffy, older men sitting in betting shops all day spending their pennies on the horses and dogs. After experiencing gambling addiction for over 10 years and meeting many people struggling with this awful illness, let me tell you it affects everyone from all walks of society. With the increasing ease and social acceptance of online gambling and advertising in our lives, nobody is immune from this illness.

I’m Michael, a recovering gambling addict, who lost almost everything to gambling – and if we weren’t plunged into lockdown in March 2020, I doubt I’d still be here to write this blog. I had a great upbringing, am highly educated and have a very good job; this being one of the few things I haven’t lost to gambling. In my mid-30’s I should be looking to settle down, buy my first property and look forward to the future. Instead, I am faced with paying tens of thousands of pounds to multiple creditors after decimating my savings and taking out various types of credit I was unable to pay back. 11 account defaults later, I’ve come clean to all my creditors and am one year into paying back my debts.

Putting on the brakes

Like many illnesses, you’re never cured of gambling addiction. You live with this disease forever and I now manage this illness in a similar way to my long standing mental health condition – writing this blog is one way that I hope helps others not to fall foul of a gambling industry that has no interest in your wellbeing or where you end up. As long as they keep taking your money, they don’t care. With a review of the 2005 Gambling Act currently underway, this is a crucial time for the government to intervene to put the brakes on an industry that is out of control.

I have been impressed with the response from the financial industry since I wrote to them all explaining my situation, and the excellent support I continue to receive from the NHS-funded National Gambling clinic. Immediately all interest was frozen on my accounts and I agreed manageable payment plans with each of my creditors individually. It may be many years before I can say I’m debt-free but this plan has given me breathing space to pay them back, without stopping me from living something close to a normal life.

Could this process be made easier with one source of communication to inform all financial service providers? It took me a long time to find out who I owed credit to, due to the nature of bad credit being sold to debt collectors and even now, one financial service provider is still unable to confirm who they’ve sold the debt to and who I should be paying back.

Flexibility both ways

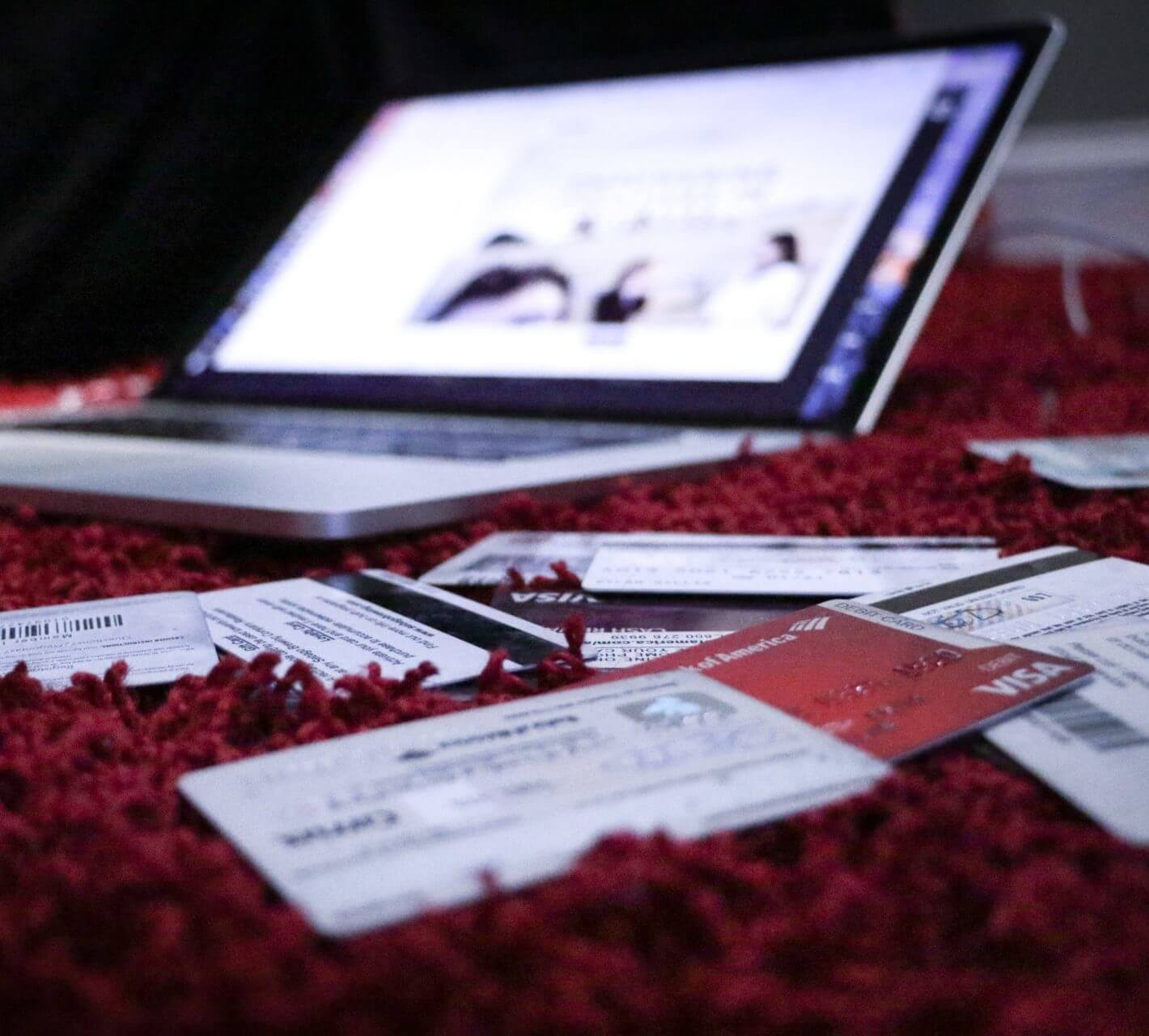

New financial service providers have entered the fray and disrupted the traditional high street banks. Many of these were the first to introduce gambling blocks on gambling transactions to customers. This has been a great move and unsurprisingly the traditional high street banks have generally followed suit. However, with all providers I can however still take out lots of cash from an ATM daily. I’ve asked all my financial service providers to reduce my ATM limit and they all said it’s not possible. If I’m able to increase my ATM limit with a quick phone call, surely the technology is in place to also reduce my withdrawal limit?

You see the thing about gambling addicts is that we always find ways around restrictions either we, financial service providers or gambling institutions put in place. We don’t want to be deceptive but there are times our urges are so uncontrollable; we’ll do almost anything to get a gambling fix. It is of course the individual’s responsibility to manage this but with banking becoming much more flexible for the customer, consideration must be given for the individual to apply tools to restrict their spending potential, not just make it easier. The more I am able to control what I can and can’t spend my money on, the more barriers I have in place to reduce the ability for me to fall down the gambling black hole again.

The opportunity for change

Finally, I feel guilty that I owe financial providers so much money. While the gambling industry has taken all my money and has no ongoing requirement to support me, the financial service providers are left to pick up my problem for many years to come. The gambling industry is powerful but the finance industry is even more so. I urge them to use this review of the 2005 Gambling Act to put pressure on government and the gambling industry so that they are not left to pick up the pieces when people like me reach rock bottom.

I look forward to seeing how far reaching the changes to the 2005 Gambling Act are and encourage anyone who is concerned about their gambling to reach out for support before it’s too late.

If you’re in need of support with your gambling, you can contact the free National Gambling Helpline, open 24/7, on 0808 8020 133. You can find more information here.

Over the last two years, Money and Mental Health has been exploring the opportunities for financial services firms to tackle gambling harm, funded by the Gambling Commission. Our best practice guide for financial services firms highlights the key areas in which banks and building societies can make a difference to customers. Our 2021 conference can be watched back here.