Francesca Smith, Research Assistant, Money and Mental Health Policy Institute

How ethnicity can affect our experiences of money and mental health problems

19 April 2023

One in four of us is affected by mental health problems at any given time. So there is no singular, universal ‘money and mental health’ experience. How we experience the cycle between the two is diverse, and can be impacted by a number of different factors, including our ethnicity.

While our experiences of money and mental health are not predetermined by our ethnicity, new research we’ve published today outlines some of the specific challenges people from minoritised ethnic groups can encounter. We also explore how these can compound the toxic relationship between our mental and financial health.

Barriers to good financial health

We know that people from minoritised ethnic groups are disproportionately affected by the social and economic factors that can increase our risk of poor mental health, such as low income, social exclusion and racism. We wanted to better understand how being from a minoritised ethnic group and having a mental health problem can mean people encounter overlapping barriers to good financial health.

“I think it’s clear there is structural racism within our society – this obviously has an impact on both people’s mental health as well as their finances.” Expert by experience of Indian ethnicity

Being able to weather the financial storms that life throws at us, like a sudden loss of income or an unexpected expense, is critical to our mental and financial wellbeing. But some of us face significant and systemic barriers to building this financial resilience.

While those of us with mental health problems can experience barriers to a good income, people from minoritised ethnic groups can face additional barriers on top of those to getting into work, being promoted, or being paid fairly. These compounding barriers to employment make it harder to secure a good income, and, in turn, to build financial resilience.

“Discrimination in the workplace makes it difficult to feel secure in the fact you will get another job if you were to lose your current one.” Expert by experience of Caribbean ethnicity

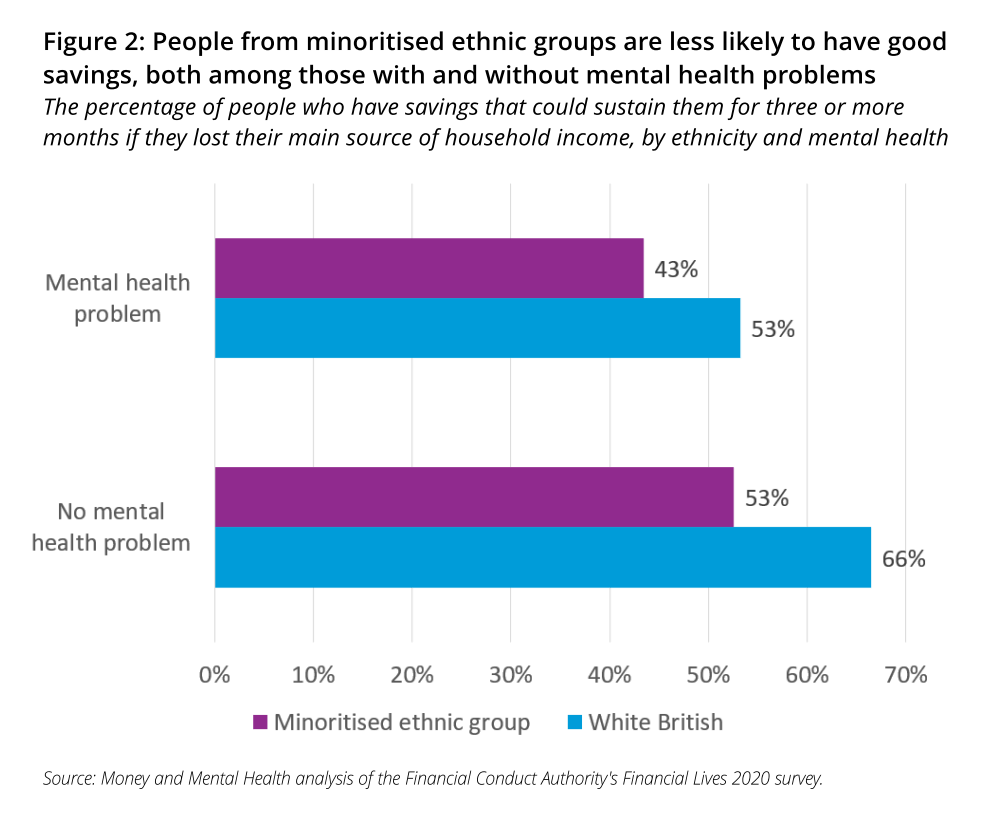

This is reflected in the data we analysed on savings. There is a disparity in levels of savings based on ethnicity before having a mental health problem is introduced. When you add mental health problems into the mix, the level of savings White British people experience reduces to that which people from minoritised ethnic groups without such conditions start at (53%). And for those from minoritised ethnic groups, the mental health penalty means they end up with far lower levels of savings (43%). The compounding penalty of being from a minoritised ethnic group and having a mental health problem was a recurring theme in our research, that also played out across levels of employment and debt for some groups.

The inaccessibility and inadequacy of support

Not only can people from minoritised ethnic groups face significant challenges to good mental and financial health, but they can also experience greater barriers to accessing support that can help break the cycle between the two.

There’s a whole series of reasons why mental health services, essential services such as banks and energy companies, and money advice services can be especially inaccessible to certain groups. It might be that you’re limited to interacting with White British healthcare professionals who don’t always understand how being from a minoritised ethnic background has impacted on your mental health. Or, for example, getting to grips with services might be difficult if English isn’t your first language.

“I’ve never had an appointment with a mental health professional who wasn’t White. I end up having to explain the nuances of why a particular incident was so bad. […] That’s another layer of difficulty and extra work. More emotional labour.” Expert by experience of White and Indo-Caribbean ethnicity

What’s perhaps most troubling, though, is that when people from minoritised ethnic groups are able to seek help, they can find themselves experiencing discrimination from the very services that are there to lend a hand. This risks making the problems they face even worse, deterring them from asking for support in the future and, ultimately, exacerbating the vicious cycle between money and mental health problems.

Improving our understanding

The generally poorer outcomes facing people affected by mental health problems from minoritised groups are evident. However, a better understanding of the drivers behind these outcomes is needed. Limited representation of people from minoritised ethnic groups in national datasets has curtailed an in-depth understanding of this complex interplay between ethnicity, mental and financial health.

As an important next step, we want those producing national statistics – such as the Office for National Statistics and the Department for Work and Pensions – to improve the representation of people from minoritised ethnic groups in their datasets, so that we can better understand what’s causing this diversity of experience going forward.

No need to wait for better data

This need for better data is not cause to hesitate before taking other, immediate action. Support services, employers and essential services must take steps to address the inequalities that people from minoritised ethnic groups with mental health problems clearly face. This includes working to deliver services that are responsive to the experiences of different groups, so that the accessibility and quality of support for people from minoritised ethnic groups with mental health problems is improved.

Ensuring everyone has equal access to support that can help break the links between poor mental and financial health is vital in addressing the worse mental and financial outcomes that people from minoritised ethnic groups currently experience.