Dr Rachel Gordon, Research Associate, Newcastle University, and Dr James Ash, Senior Lecturer, Newcastle University

High-cost short-term credit: The significance of borrowing money online

Many people now access high-cost short-term credit online. By using personal devices, like smartphones and laptops, people can search for, apply for and manage credit whilst at home, at work or on the move, at any time of the day or night. This has transformed the accessibility and speed at which people can get credit. The spaces and times within which people can apply for and use it have changed too.

These changing borrowing practices, and how they affect consumers’ personal and financial wellbeing, have been the focus of new research at Newcastle and Durham Universities. The research, which was funded by the Economic and Social Research Council, studied people’s real-life experiences of using devices and websites to apply for credit online.

Spaces and times matter

People’s feelings and the circumstances they are in at the time of borrowing actually shape their borrowing decisions. Decisions are not made in a vacuum. People apply for credit at home in the kitchen whilst making dinner, in bed at night, during their lunch break at work, whilst travelling on the bus, at a rugby game, when out with family, in the pub on an evening, on holiday or whilst shopping in town. Many decisions are made quickly, helping people deal with an immediate need for, or worries they have about, money. This relief is only short-lived though, as those needs and worries return at a later date, often leading to repeat borrowing.

About 40% of people we interviewed described their use of high-cost credit as impulsive, because it was so quick and easy to access online. People borrowed for different reasons, which were tied to their personal, psychological or emotional needs. People experiencing significant life changes, like relationship breakdown or redundancy, told us how online access to credit helped them fill a gap or boost their mood. People living with mental health problems experienced periods of illness that would lead to additional spending fuelled by quick credit. Others engaged in impulsive spending with no real purpose or need.

Influenced decisions

Borrowing decisions are also shaped by the loan websites people use. These websites are carefully designed and heavily tested to remove friction and speed up the application process, enabling quick and easy decisions. This leaves very little space for people to properly think about the decisions and their consequences.

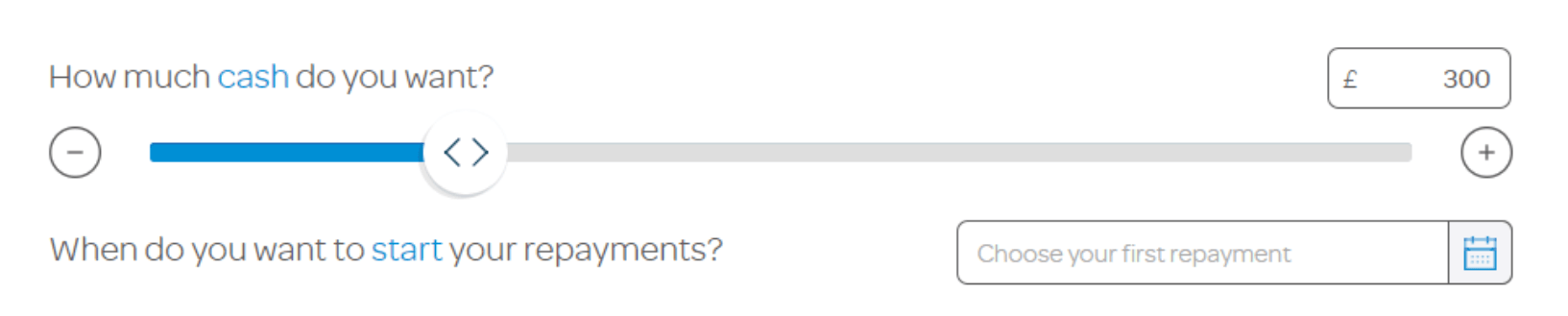

Sliders are a significant part of many high-cost credit websites. By moving the sliding bar, the consumer is able to choose an amount to borrow, set the repayment date and receive an instant calculation of the total loan cost. The significance of this is twofold. First, it is designed to make the consumer feel ‘in control’; they make the selections. This is particularly powerful for people who find themselves in chaotic or precarious financial situations, as they feel like they are taking responsibility of their money. Second, the instant total cost calculation gives the impression of openness and transparency. This builds trust and puts consumers at ease. This becomes problematic when it boosts consumer confidence on superficial grounds, by creating an illusion of consumer control. In reality, consumer choice is always limited by the parameters set by the lender and shaped by the tools that mediate decisions.

Next steps

As part of the research, we have produced a report with recommendations on how we think the market should be regulated to deal with issues around access to and instantaneity of credit. They are available on our project website to download and read. We are also working on a digital tool that explores what it is like to take out high-cost credit. We will have details of this to share with you very soon.