Chris Lees, Senior Research Officer, Money and Mental Health

Always on your mind? Long-term money and mental health problems

20 March 2024

- Today we’ve published new research looking at the long-term cycle of money and mental health problems – making recommendations for breaking and preventing that cycle.

- This blog focuses on the findings of the new report, Always on your mind.

- The report shows that 800,000 people experienced long-term mental health problems and financial difficulties, from right before the pandemic to the onset of the cost of living crisis.

- It also warns that as many as 3.4 million people could be at risk of falling into this long-term cycle in the coming years – unless the government and other agencies step up preventative support.

Over the last eight years our research has shone a light on the toxic cycle between mental health problems and financial difficulty. But we’ve often focused on the cycle at a particular point in time, like the cost of living crisis or pandemic – or on particular issues, like gambling or mortgages. The truth, however, is that for many people, money and mental health problems are an ongoing, interconnected and often life-long reality.

Today we’re launching a new report – Always on your mind – that looks at the long-term experiences of money and mental health problems. In particular, the report explores the impact the length of time we experience these issues has on us. With people still struggling with increased costs, rising levels of mental health problems in the UK, and support services at breaking point, this research was essential. Our next blog looks at how to disrupt this cycle but, for now, let’s dig into what we found.

Time isn’t always a healer

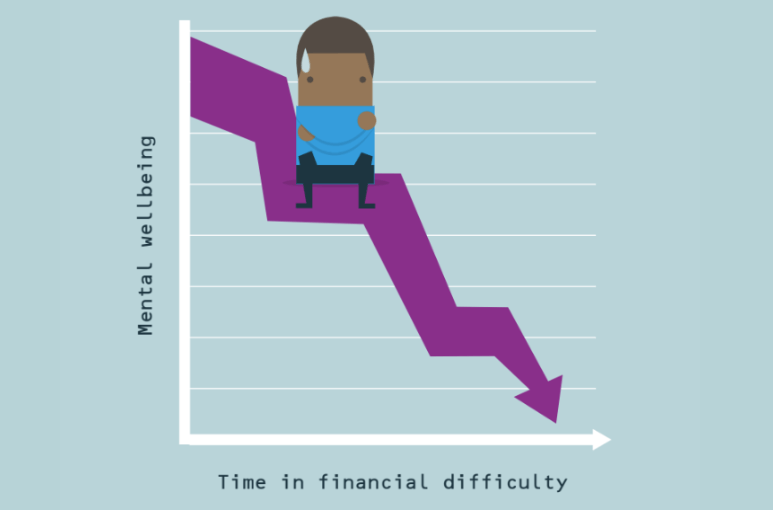

We found that the length of time we struggle with our mental health significantly increases the likelihood we’ll end up struggling with our finances. For example, compared to never having a mental health problem, having one persistently (for three or four years out of four) makes it over nine times more likely you’ll be finding it difficult to manage financially. But having a mental health problem for one or two years makes it just over three times more likely compared to those who never had a mental health problem.

Similarly, the longer we struggle with our finances the more likely we’ll have a mental health problem. Finding it financially difficult for three or four years (persistently) can make it 5.5 times more likely you’ll have a mental health problem at the end compared to those who never found it difficult. Again this increase is larger than for those who found it difficult for one or two years (three times more likely compared to never finding it difficult). So what’s driving this impact?

Employment and bills

When we spoke to our Research Community – a group of around 5,000 people with lived experience of mental health problems – there were two common experiences at the heart of long-term money and mental health problems: employment and debt.

Members told us about how they struggled to stay in work when they became unwell and getting back into work became harder the longer they were ill. And the data supported this. Those who had a persistent mental health problem were 11 times more likely to be out of work due to disability or illness compared to someone who didn’t have a mental health problem at all.

“I tried very hard to maintain a full time job but the symptoms have been so severe, I ended up going off on long term sickness and then having to change jobs. It makes me feel guilty and useless which then just makes mental health symptoms worse. The more financial difficulty I get into, the worse I feel but I can’t seem to break the cycle.” Expert by experience

Research Community members also talked about incurring debt when unwell. For example, common symptoms of mental health problems, such as increased impulsivity, can lead to people overspending and falling behind on payments. Members would then get stuck in debt for a long-time which then significantly impacted their mental health.

Again, this was reflected in the data. Having a mental health problem persistently increased the likelihood that someone was behind on bills by 3.6 times compared to someone who didn’t have a mental health problem.

“I had a manic episode and got into £40,000 worth of debt in a very short period of time. I’ve had to get a debt management plan and I’m possibly going to have to go bankrupt due to having to leave work because of my illness and my income reducing. If I don’t go bankrupt I’ll be paying off the debt for the rest of my life.” Expert by experience

While employment and debt are two key factors, we know that there are many others at play and each person’s experience of long-term money and mental health problems is unique.

What it’s like to live with long-term money and mental health problems

The stats above are powerful, and make clear that there is a real need to break the long-term money and mental health cycle. But the experiences of the Research Community really bring this home. While our analysis focused on a four year period, many people experience this cycle throughout their lives. Being out of work, being in debt or constantly having to juggle a tight budget for a long-time can all have a significant impact on our mental health.

“I can’t see a way out of the cycle. I can’t afford to pay more off our debts so they keep mounting. I can’t be accepted for low or zero interest finance so I can’t see a way forward. It is all-consuming which in turn makes me very anxious and depressed.” Expert by experience

We cannot overlook this issue. We estimate that nearly 800,000 people aged 25-54 in the UK have experienced persistent money and mental health problems. A further 3.4 million people have experienced a combination of these issues for varying periods, such as persistent mental health problems but shorter term financial difficulty. We need to act now or we risk many more people getting stuck in the long-term cycle.

This is not an inevitability. There are key roles to be played by the government, regulators, essential service firms, mental health services, and debt advice providers. In particular, more needs to be done to ensure support for people’s finances and mental health is joined up and that we are tackling these dual issues together. Our next blog will look at how to disrupt the long-term cycle in more detail.