Liam Hill, External Affairs Intern, Money and Mental Health.

Launching our campaign to Stop the #DebtThreats in parliament

14 December 2018

“If there’s one phrase I really hate,” our founder and chair Martin Lewis began, “it’s the phrase ‘it’s only money’. Money is a core wellbeing issue, and this new research bears that out.”

Martin was speaking at the recent parliamentary launch of our new report, A silent killer, in front of an audience of national and local politicians, and representatives from the debt, mental health and financial services sectors.

The report explores the links between financial difficulty and suicide. It shows that one factor which can leave people in debt feeling there is no hope is the intimidating letters they receive from lenders. That’s why we also used the event to launch our new Stop the #DebtThreats campaign, with a range of speakers who spoke powerfully of the need to bring an end to the use of intimidating language in debt letters.

Tracey Rogers

We were incredibly privileged, first of all, to be joined at the launch by Tracey Rogers, whose son Jerome took his own life in March 2016, aged just 20, after two initial £65 parking fines turned into thousands of pounds in debt, after being passed on to a private collections firm. Tracey spoke with great courage about how the intimidating letters and texts from the debt enforcement company, combined with frequent visits from bailiffs, left Jerome feeling like he had been backed into a corner.

Tracey used her speech to call for the bailiff industry to be independently regulated, reflecting the aims of the ‘Taking Control’ campaign backed by a coalition of charities including Money and Mental Health. She also added her support to our #DebtThreats campaign, saying the letters Jerome had received from the bailiff company were intimidating, uninformative, and failed to signpost to outside help or specialist debt advice providers. Tracey’s insight, bravery and clarity were commended by each speaker who followed, and powerfully underlined the urgency of addressing the link between financial difficulty and suicide to everyone present.

![Copy_of_-34[1]](https://www.moneyandmentalhealth.org/wp-content/uploads/2018/12/Copy_of_-341.jpg)

Jackie Doyle-Price MP

Tracey’s powerful story was followed by a speech from the Minister for Mental Health, Inequalities and Suicide Prevention, Jackie Doyle-Price. The minister welcomed Money and Mental Health’s report, adding that too often suicidal thoughts arise because people feel they can’t cope and want to escape the pressure, and that over-indebtedness can add to these feelings. She welcomed the fact that regulators from financial services had attended the launch too, and emphasised a ‘cross-society approach’ to suicide prevention.

Professor Louis Appleby

Professor Louis Appleby, who leads the National Suicide Prevention Strategy for England, underlined that while we have long associated unemployment with a rise in the likelihood of suicide, there is also a growing understanding of other complex factors which can increase risk, including the role of debt. He said the most common thread among people who attempt suicide is a feeling that their problems are escalating, and said that letters with threatening or intimidating wording can contribute to that escalation.

![Copy_of_-46[1]](https://www.moneyandmentalhealth.org/wp-content/uploads/2018/12/Copy_of_-461-1.jpg)

Luciana Berger MP

Luciana Berger, the MP for Liverpool Wavertree and a member of our advisory board, reflected on the success of our Recovery Space campaign, and underlined the importance of grounding such initiatives campaigns like this, and our new Stop the #DebtThreats campaign, in robust evidence.

Luciana focused on the detail of the report, highlighting the deficiencies of some local authority Suicide Prevention Plans. Too often the plans lack recognition of the importance of specialist debt advice in ensuring problem debt doesn’t leave people feeling trapped or hopeless. While recognising the financial pressure authorities are under, Luciana cited the example of Liverpool Council, which has made debt advice available through WhatsApp in a bid to reach more people.

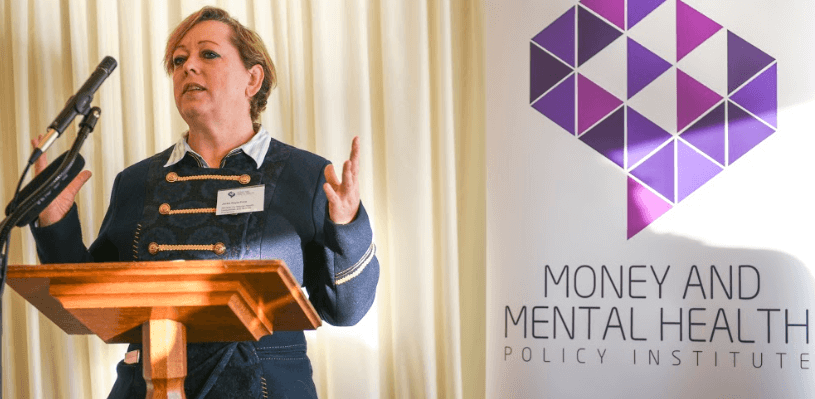

![Copy_of_-48[1]](https://www.moneyandmentalhealth.org/wp-content/uploads/2018/12/Copy_of_-481.jpg)

Sarah Mackenzie

Sarah Mackenzie from the Financial Conduct Authority (FCA) reminded the audience that 72% of people with mental health problems were unhappy with their financial circumstances, compared to 52% of the rest of the population. She added that the FCA is working with firms to make guidance around vulnerability and disclosure more useful.

Finally, Sarah announced details of an upcoming FCA/Money and Mental Health project exploring the potential for financial firms to use data to identity people who are struggling with their finances, and to address the ethical challenges this poses. Watch this space for more details in the coming months.

![Copy_of_-51[1]](https://www.moneyandmentalhealth.org/wp-content/uploads/2018/12/Copy_of_-511.jpg)

Johnny Mercer MP

MP for Plymouth Moor View since 2015, Johnny Mercer said his involvement with Money and Mental Health was one of the parts of being an MP that makes the role really worthwhile. He paid tribute to the team for the campaigns on Recovery Space and the Debt and Mental Health Evidence Form, before adding his support to our #DebtThreats campaign, stating that letters from lenders can make people feel ‘profoundly alone’ and amount what feels like an ‘intensive bullying escapade’ by creditors.

![Copy_of_-52[1]](https://www.moneyandmentalhealth.org/wp-content/uploads/2018/12/Copy_of_-521.jpg)

Helen Undy

Our Director Helen Undy closed the launch, reserving special thanks for Tracey Rogers, for her courage and for helping to ground the campaign in a true and tragic story, and to Nikki Bond and Merlyn Holkar, for authoring the report from which this campaign has blossomed. She concluded by urging people to support the campaign, saying the outdated legislation governing these letters is both morally indefensible and straightforward for the government to fix.