Kiri Saunders, External Communications Manager, Christians Against Poverty (CAP)

How CAP helps people with mental health problems

January is often acknowledged as the most expensive month. With a record number of households putting Christmas on their credit cards in December, January will be the month when it comes back to bite. For many families and individuals across the UK, the festive period comes with added pressures to spend money, whether that is on food, presents, travel or events. For those unable to afford these luxuries, they either have to use credit or go without, both options creating additional pressure and stress. For people struggling with mental health problems, these financial demands can compound their issues and exacerbate the symptoms.

Christians Against Poverty (CAP) has 21 years of experience as a debt management charity, helping people out of debt and poverty across the UK.

Tabitha's story

Each January, CAP receives a record number of calls to the New Enquiries team with people wanting to get help with their debts. There was a 67% increase in calls between December 2016 and January 2017. Yet, across the UK, there are thousands of people in debt who do not seek help. For many, mental health problems are a significant reason for this, as even making a phone call becomes a daunting task. It can be an overwhelming job to assemble paperwork and negotiate repayment terms with creditors.

For Tabitha*, a CAP client, debt had contributed to her mental health problems. She was signed off from work with depression and anxiety. She had credit card bills for everything, including food shopping, so she was hardly eating. The stress of her financial situation also caused sleepless nights. She got to the point where she tried to take her own life.

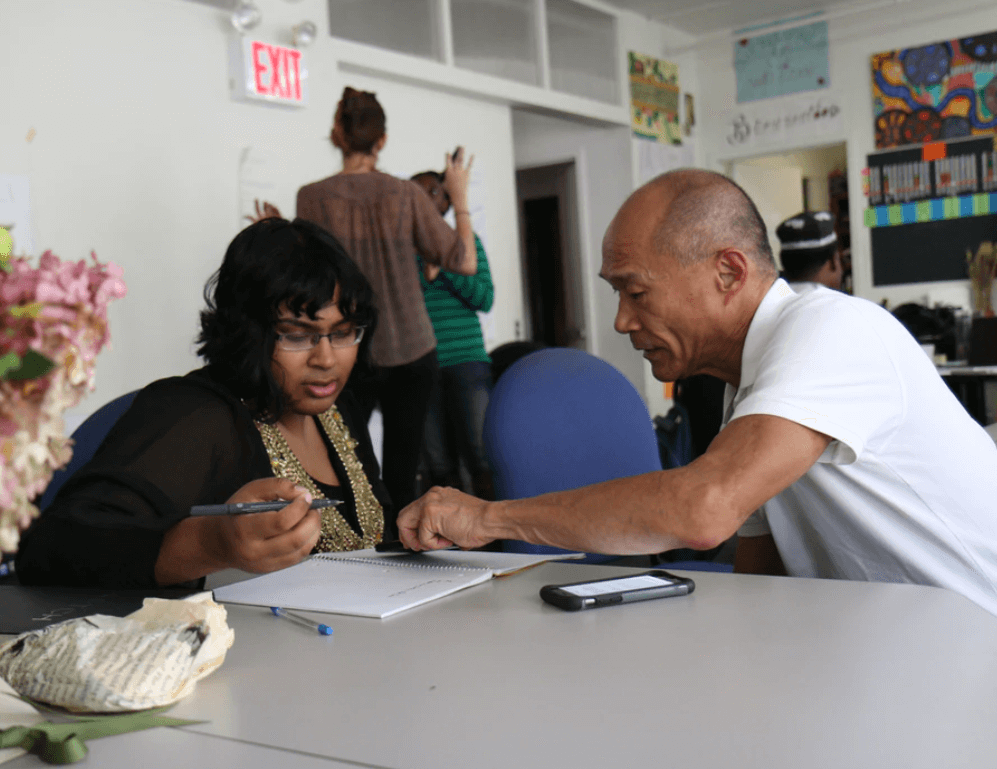

CAP understands the difficulties of struggling with mental health problems and being in debt. CAP’s service is well designed to help people with mental health problems because it operates using a free face-to-face service, offering both practical and emotional support. CAP’s operation is particularly suited to helping those with multiple and complex needs, those who would struggle to deal with their financial situation through a telephone or online system. The face-to-face model means that a local CAP Debt Coach will visit someone in their own home, helping them to collect paperwork and create a complete picture of their financial situation.

At her lowest point, Tabitha explains:

“I was so desperate, I couldn’t cope with life and didn’t want to live anymore. I was told by a friend to speak to CAP. She told me that they would help me with my debts. I wasn’t so sure, I was in arrears everywhere. I got in contact with CAP and straight away I began to feel the pressure lifting.”

Providing peace of mind

Money and Mental Health’s research has highlighted that mental health problems can make it harder to open the post or communicate with financial services firms. CAP tries to help by providing Freepost envelopes to those in debt, where they can put in any bills or statements that come through the home letter box and send them straight up to head office. This takes away the additional pressure of opening post and having to deal with final notices or threats. CAP also give clients a letter that they can hand to any enforcement agents, explaining that they are working with CAP to resolve their debt situation. The letter informs the agent that they should contact CAP head office, rather than the individual in debt. This can provide additional peace of mind.

Many people feel as though they must deal with their mental health problems and finances alone. In fact almost two thirds (63%) of CAP clients delayed seeking help because they were trying to resolve their situation themselves. Seeking debt help and having someone else go through all the paperwork, negotiate with creditors and create a budget can in turn relieve the symptoms of stress, anxiety and depression. No one should have to struggle with debt alone, which is why CAP would strongly recommend seeking debt help. There are a variety of free organisations that offer debt advice, and depending on the type of service required each one can cater for a diverse range of needs.

It's never too late to get help

“With CAP’s help my life is so much better. I have been off antidepressants for over a year and I am really close to becoming debt free. I can sleep at night, after years of broken sleep and constant mental and physical fatigue. I can’t thank CAP enough.” (Tabitha)

So if you are in debt, or know someone who is struggling, CAP can help.

You can call CAP for free on 0800 328 0006 or visit their website.

*Name has been changed to protect identity