Helen Undy, Head of External Affairs, Money and Mental Health

Making a house a home

Latest figures reveal a concerning rise in demand for emergency charitable grants

What would you do if your fridge packed up tonight? Could you buy a new one? Or would you have to manage without it? Last week alone, 700 people faced a scenario like this, and found themselves applying to charity Turn2us for help. They join the tens of thousands of people who applied for help to buy basic household items in the last few years.

“[I have] constant worry about the future. I’ve no oven at the moment, the kitchen has fallen off the wall and my flat is full of damp.”

In the news this week

The Independent this week reported that requests to the charity for help with buying basics like fridges and washing machines were up 244% since 2013, when the national Social Fund scheme was abolished. Under the scheme, applicants in receipt of certain benefits could apply for a grant to meet costs associated with circumstances like family breakdown, the onset of a disability or health condition, or flooding. The grants could help people to buy furniture to set up a home after leaving the care system or temporary homeless accommodation. They helped victims of domestic violence by providing the means to make a new unfurnished flat feel a little more like a home, and they helped people leaving residential care or institutional settings to start an independent life – with at least some cold milk for their cup of tea in the morning.

When the scheme was scrapped in 2013, responsibility was transferred to local councils – but the money wasn’t ring-fenced, and councils’ budgets were repeatedly cut. As a result, many councils have dramatically cut back the emergency grants and loans available, leaving charities to step in where they can.

“I had no furniture and would be sat in my flat sometimes with no heating due to not having the money to pay for it. I didn’t have a cooker and couldn’t stock up on food because I also had no freezer, so had to eat cold sandwiches.”

Feeling worthless

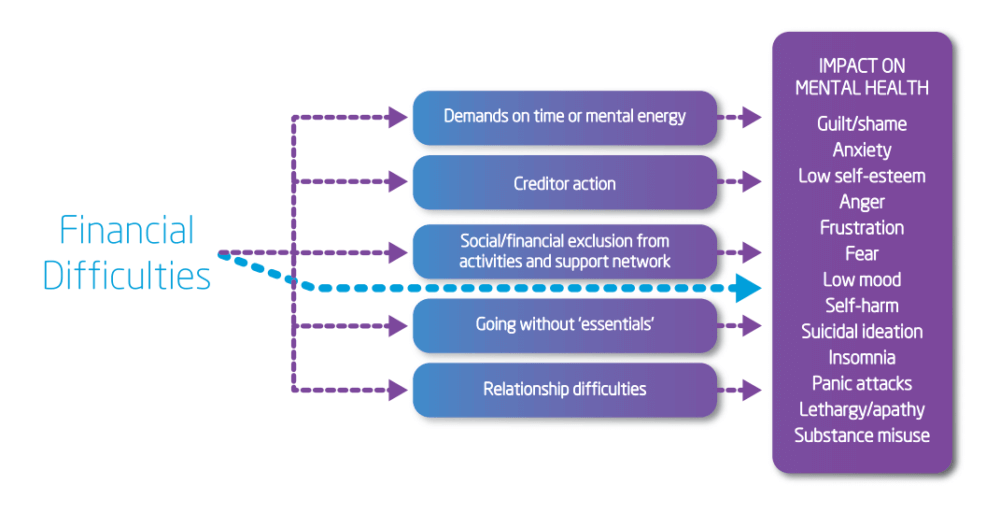

It’s not hard to imagine what it does to your mental health, keeping the milk on the kitchen counter, or living on microwave meals because you don’t have a working oven. Our research found that ‘going without essentials’ as a result of financial difficulty has a significant impact on mental health, with many of the 5,500 respondents to our survey reporting feeling ‘worthless’ as a result.

This is likely to be compounded by the fact that many people who suddenly find themselves in financial difficulty do so because of circumstances like relationship breakdown, abuse or illness. Circumstances which mean that our mental health is already likely to be affected, and our resilience to cope with further difficulties, like a broken oven, reduced.

“Not having a steady or high income can make worries about the future and even survival very tough, one thing costing a lot of money (for example a new washing machine)… will cause pressure.”

Credit with a cost

Turn2us reported that half of those who came to them for help had previously used high-cost credit as they didn’t have another means to pay for essential items. This type of credit can quickly lead to financial difficulty as a result of high interest rates and charges – financial difficulty that causes stress, anxiety, low mood, frustration and all of the other impacts on mental health listed on the diagram above.

It’s a vicious, messy cycle. And one in which access to £200 to replace a broken fridge really can make a huge difference. This week saw the Department for Communities and Local Government renamed ‘Housing, Communities and Local Government’, to reflect the Prime Minister’s ‘renewed focus’ on tackling the housing crisis. While that focus may be helpful, the figures from Turn2us show that this is not just an issue of bricks and mortar – to make a house a home, it takes more than just a front door.