This blog was published following campaign progress we made in October 2020. To learn about our new campaign push and why we’ve relaunched ‘Stop the #DebtThreats’ during the cost of living crisis, visit our campaign page.

Katie Alpin, Interim Chief Executive, Money and Mental Health

We stopped the most distressing Debt Threats!

7 October 2020

Today, I’m delighted to share with you some really exciting news on our Stop the Debt Threats campaign. Nearly two years after we launched the campaign, the government has announced that they will make changes to the rules on the content of the most distressing debt collection letters. With millions of people facing financial difficulties as a result of Covid-19, this news couldn’t be better timed.

Money and Mental Health research on the links between debt and suicide found that the thuggish letters sent to people in problem debt can be a trigger for suicidality. While the links between debt and suicide are complex, these letters, written in shouty capital letters, full of incomprehensible legalease and threats of court action, can leave people feeling isolated, hopeless and trapped.

With many people already struggling with poor mental health as a result of the precarious economic situation, bereavement and loneliness of lockdown, and rates of mental illness expected to rise in the years ahead, this small but vital step will help protect people when they may be most vulnerable.

What's changing?

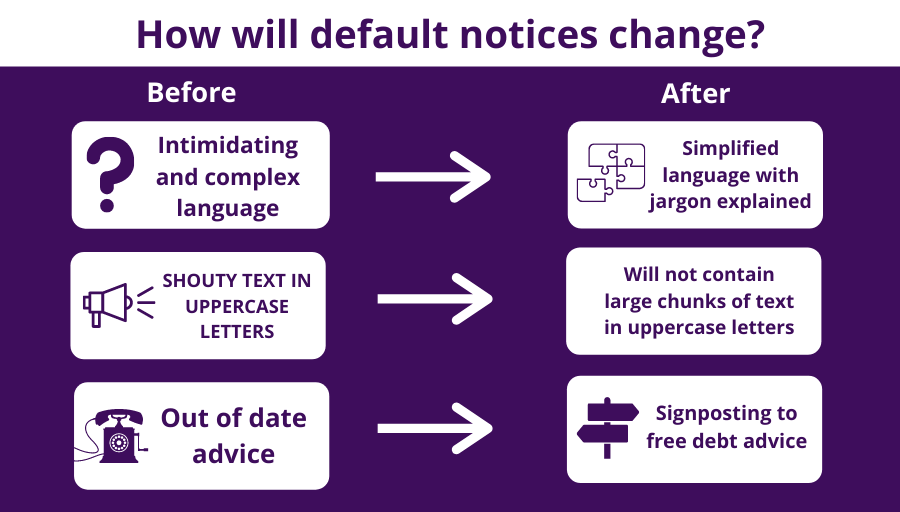

The simple changes the government has agreed to make to the rules about default notices – the most intimidating debt letters – will make a big difference. They include:

- Removing the requirement for large chunks of text to be written in capital letters – which most of us read as being shouted at.

- Making the letters easier to understand, by adding explanations of complex legal terms where these have to be used.

- Updating the signposting, which was previously badly out of date, to help people find free debt advice.

These changes will make a huge difference to people facing debt and distress due to the pandemic, and could even save lives.

A big thank you

We couldn’t possibly have secured this change without widespread support. Thank you if you were one of the 12,000 people who signed our petition calling on the government to change the rules, and a specially big thank you to the members of our Research Community who shared their experience of receiving these letters through the research, in the media or at our events. It’s your stories that helped us make the case for change.

We’re also enormously grateful to all the charities (more than 30!) who supported the campaign, and to the six financial services providers who came on board too. This really shows that when we agree on the action that needs to be taken, we can get the government to listen and secure the change we need.

But there’s still more to do

We’re delighted that these changes are being made to the most distressing debt letters. But this isn’t the end of the story, and there’s lots more work to be done to ensure that the communications people receive from creditors when they’re in problem debt are as supportive as possible. We know that this should help businesses as well as customers, as more people should engage with the process at an earlier stage, when things are easier to fix.

In the coming year, Money and Mental Health will continue to push the government to change the rules on all debt letters, so nobody has to receive outdated and inappropriate letters. And we’ll work directly with lenders too through our Mental Health Accessible programme, to help businesses make their communications as supportive as possible.