Dr Simon McNair, Policy Advisor; Rosanna Barry, Principal Advisor; Chloe Jacob, Research Advisor, Behavioural Insights Team

Reducing risky gambling using behavioural insights

5 April 2021

Great Britain is home to the biggest regulated gambling market in the world. One-in-three British people have gambled in the past four weeks – this figure rises to 47% if we include playing the National Lottery.

While gambling can be a casual pastime for some, for others it can cause severe financial and emotional harm. In numbers, around 350,000 people in Britain experience ‘problem gambling’, meaning they experience a level of gambling harm involving a high degree of behavioural, social, and psychological consequences. A further 1.8 million people are deemed to be ‘at risk’ of gambling harms. On average, problem gambling can negatively impact six other people closely-related to the gambler experiencing harm.

How to make gambling safer

In 2017, the Behavioural Insights Team was commissioned by GambleAware to explore whether behavioural science (the study of human behaviour, and how and why we make decisions) could help to reduce risky gambling. To investigate, we set out a wide range of research activities. One key finding from the first phase of our research was that applying behavioural insights can have a substantial impact on the uptake of safer gambling tools, but this did not substantially impact subsequent gambling behaviour. Our latest work goes a step further and asks how these tools can be made more effective.

Anchoring and deposit limit tools

Deposit limits are one type of safer gambling tool, and are a common feature on online gambling platforms. They are used to cap the amount of money that someone is able to deposit each day, week or month. Customers are typically required to choose from a menu of predefined options, such as £10,000, £5,000, £1,000 and £5 — usually starting with the largest deposit limit available, which in some cases can be as high as £100,000.

A key principle in behavioural science is that our choices tend to be influenced by a suggested reference point — an effect known as “anchoring”. Given we know that these anchors can influence behaviour, we wanted to examine whether exposure to larger anchors — that is: the high denominations given as options for deposit limits — might influence customers to set higher gambling deposit limits for themselves than they otherwise would.

The trial and findings

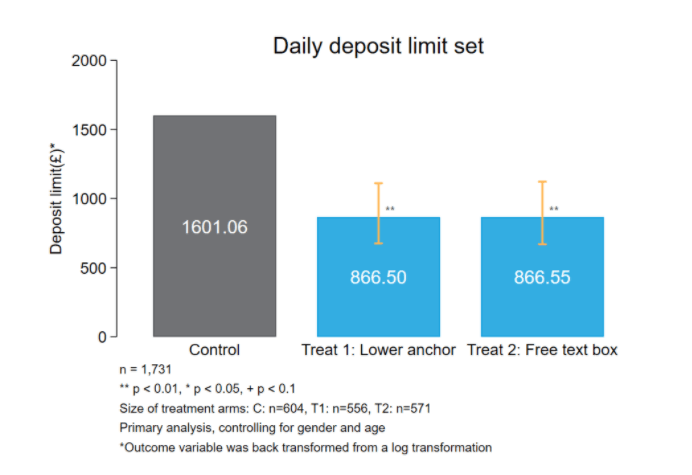

In the first field trial of its kind, we worked with major British gambling operator bet365 to test two deposit limit variations against the business-as-usual approach. In one group, deposit limit options were presented with lower values, the largest being £250. In another, there were no values at all. Participants were instead asked to set a deposit limit using a free text box. The third group was ‘business as usual’ (with anchors as high as £100,000).

Importantly, the two new variations did not remove customers’ ability to set high limits; the change was merely how the options were presented.

Our first analysis measured the size of the initial deposit limit set by customers across each of the three variations. The results were profound. Compared to the ‘business as usual’ group, our findings suggested that customers’ average deposit limits would be 46% lower with the free text box option and 45% lower with the lower deposit suggestions. We also found that on average, an individual deposited less money into their account over 30 days under the two interventions. However, these latter results were not statistically significant.

So what next?

In December last year, the UK government announced a major and wide-ranging review into the 2005 Gambling Act, described as “an analogue law in a digital age”. Our work continues to show the significant impact that behavioural insights can have on modernising the regulatory landscape and creating better, easier to access, safer gambling tools for consumers. Our work to date has shown that simple, low-cost changes can improve both the uptake, and effectiveness of safer gambling tools.

Following our trial and its primary findings, we have three key recommendations:

- Customers should be presented with a free text box with no visible or suggested minimum/maximum values when setting deposit limits.

- Operators should apply known effective methods to increase uptake of deposit limits, continue to test what works, and share those insights.

- More research funding must be directed towards causal evaluations that will yield insights to inform policy and be scaled across the industry.

While we recognise that progress is being made across the industry, much more work is needed to test the impacts of online gambling features, using randomised controlled trials in live business environments. Only then will robust, independent evidence exist to inform policies, practices and procedures.

Today is a crucial and opportune time for policymakers, researchers and the industry to drive much needed positive change.

As part of a two year programme with the Gambling Commission, Money and Mental Health is continuing to explore the opportunities for financial services firms to tackle gambling harm. If you work in financial services and would like to keep up to date with this programme, sign up to our professional network here.

You can also watch our conference for financial services professionals on reducing gambling-related harm here.