Katie Evans, Head of Research and Policy, Money and Mental Health

Buy now, pay later: the problems with credit offered by retailers

Our launch survey, which collected information from nearly 5,500 people with mental health problems in spring 2016, has been a goldmine of information for Money and Mental Health. The detailed descriptions of how mental health problems can cause financial difficulties, and vice versa, have been incredibly important in helping us to plan and shape our research.

One thing that appeared time and time again in people’s descriptions of their problems was credit offered by retailers – sometimes hire purchase or rent-to-own, sometimes catalogue credit or store cards. Enough people mentioned these products to make us wonder – are there bigger problems in this market for people with mental health problems? To test this, we commissioned new national survey data from Populus, a research agency, to understand how people across the UK, with and without mental health problems, use the credit offered to them by retailers, and whether there are specific issues that mean people experiencing mental health problems are getting a poor deal in this market.

Is this another cost of poor mental health?

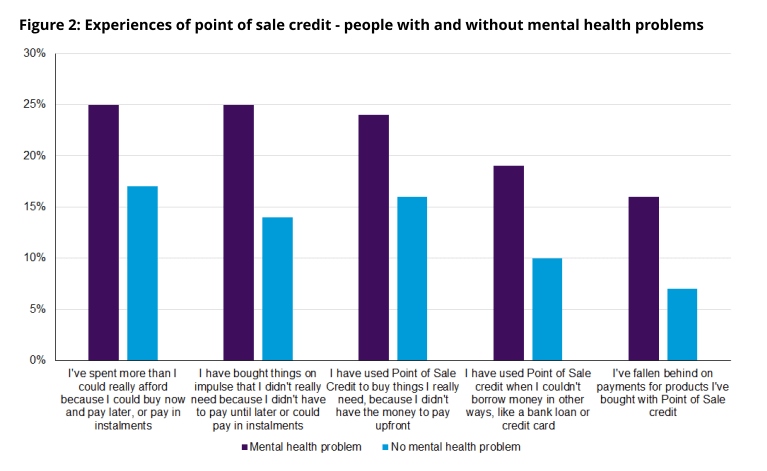

The short answer to this question is ‘yes’. Our new research, published earlier this week, shows that people with mental health problems are more likely to use credit offered by retailers: four in ten people with a mental health problem have used this sort of credit, compared to 32% of people without mental health problems. This could be simply because people with mental health problems are, sadly, substantially less likely to be in work, and to have lower incomes as a result, which might mean that big purchases need to be made with credit.

More worryingly, our research has also demonstrated that people experiencing mental health problems are significantly more likely to end up behind on payments for these credit products, or using this credit to buy things they can’t afford. People with mental health problems are twice as likely to have fallen behind on payments for products bought with using credit from a retailer (16% compared to 7% for people without mental health problems). A quarter of people with mental health problems report that they have bought something on impulse that they didn’t really need because they could pay later. For people without mental health problems, this falls to 14%.

Why is this happening?

The truth is, we’re not sure yet. This research, however, gives us some clues about what might be going on, that could be used as a basis for further research. We know, for example, that some mental health problems can make it much more difficult than usual to resist impulses. It seems that, in some cases, this increase in impulsivity can make it much harder to say ‘no’ when offered credit in a shop, and can lead people to make purchases they later regret.

“I’m more impulsive if I’m bordering a depression crash, as the ‘high’ from a retail hit could possibly ‘save’ me from going over the edge. I get anxious and sometimes just say yes to store cards as I feel pressured by the sales assistants into applying and accepting to make the transaction quicker.”

Our research has also shown how some mental health problems can make understanding complex information and comparing products much harder. This might mean that it is more difficult for people with mental health problems to understand the terms and costs of credit being offered by shops – especially when you’re making the decision at the till, perhaps with a queue forming behind you, perhaps with your kids getting bored waiting.

“I took out hire purchase and catalogue borrowing without fully being able to understand how it would affect my situation to make the repayments. As a result, I am left with little or no spare money every month to be able to enjoy life.”

Many retail credit agreements are very complex, with features like:

– Advertising a 0% interest rate which changes if you miss a payment

– Adding in costs for compulsory insurance or other add-ons, which make it hard to tell how much you’re paying to borrow the money

– Links to loyalty or reward schemes, which mean spending on a store card earn you extra points and prizes

These make working out the cost of the loan complicated at the best of times. Our evidence suggests, however, that for people with mental health problems this is causing real harm.

What would help?

These findings are only indicative, but they do suggest that something serious is going on when retailers lend money to customers, and that action could be justified to protect vulnerable customers, particularly people experiencing mental health problems. At a high-level roundtable event earlier this week, Money and Mental Health brought together a wide-range of industry experts to discuss what could be done.

As a first step, we should think about how these products are sold. Is it fair for them to be tied to loyalty schemes, or for special rates to be offered in sales periods (buy now, pay nothing for a year!). We also need to make sure that the pricing of credit is clear, and that people have time to change their minds if they decide, after making a purchase on credit, that actually the loan isn’t right for them. However it’s also important that we don’t stop people who need credit from being able to access it at all. That can, in some cases, lead to a rise in illegal money lending from loan-sharks, or other harmful practices. So, as a first step, we need more research, this time in greater depth, to help us understand how people use these forms of credit, and how it affects buyer behaviour. Armed with this information, we’ll be able to make targeted interventions, and reduce the harm caused by these products.