July financial stability report

A debt and mental health perspective on the July 2016 Financial Stability Report

Debt problems increase the chances of poor mental health – people with debt problems are twice as likely to develop major depression and 1 in 2 British adults with a debt problem also has a mental health problem.

We also know that the more debt a person has, the more likely they are to have a mental health problem. So the rise in household debt reported this month by the Bank of England could spell bad news.

Household indebtedness is on the rise

The Financial Policy Committee’s (FPC) July 2016 Financial Stability Report reports that UK household indebtedness is high by both historical and international standards, and more worryingly that it is on the

rise. The report also sets out how this rise in indebtedness has corresponded with a growth in lending to households.

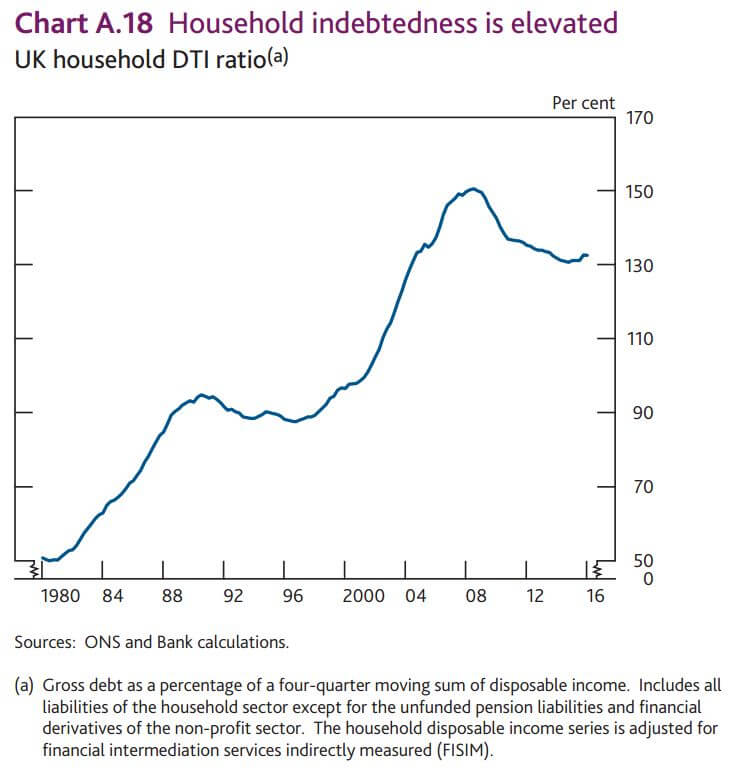

Household debt has been on the rise relative to incomes since early 2015. In 2016 Q1, the aggregate household debt to income (DTI) ratio was 132%.

The annual growth of lending to households has increased each quarter since 2013 Q2. This growth rate reached 4.1% in 2016 Q1, its highest level since 2008. The FPC say that the 2016 Q1 figures were

boosted by a growth in buy-to-let housing transactions ahead of tax changes in April, but also note that there was a particularly strong growth in consumer credit activity.

The rise in the DTI ratio means that households will be more vulnerable to falling into ‘problem debt.’ Debt becomes ‘problem debt’ when people are unable to meet repayments. People often fall into ‘problem debt’ because they lack the financial resilience to deal with an income shock, such as redundancy or relationship breakdown, or an unexpected and unavoidable bill.

The graph on the right, taken from the Financial Stability Report, puts these figures in context.

Signs of a deteriorating economic and employment outlook

The FPC state the ability of some households to service their debts would be challenged by a period of weaker employment and income growth. It is concerning, therefore, that at the same time as levels of household debt have increased, the outlook for economic activity and employment has deteriorated.

In June the FPC reported growing evidence that uncertainty about the referendum had led to delays to major economic decisions, which past evidence suggested could increase unemployment. The FPC note that there are early signs that these effects have continued since the outcome of the referendum.

The FPC is closely monitoring the number of vulnerable households and is alert to the potential risks to economic and financial stability. However, it is clear that in the context of rising household debt and a deteriorating economic outlook, policy makers also need to be mindful of the associated mental health risks.