Kate Langston, External Affairs Officer, Money and Mental Health.

Our #DebtThreats debate: the government says changing debt letters is ‘top priority’

22 May 2019

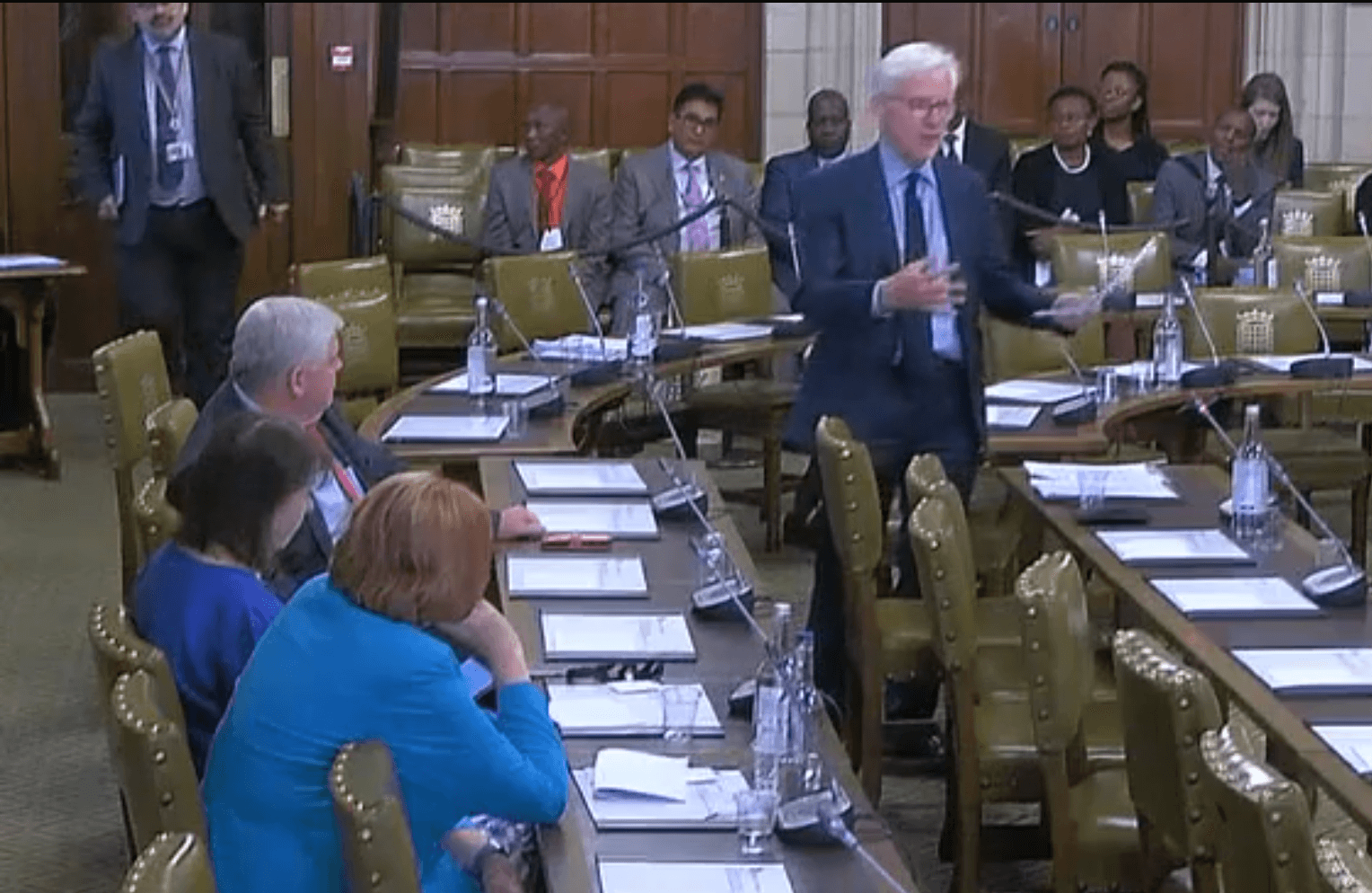

This week we celebrated another big milestone in our campaign to Stop the #DebtThreats, as MPs had a chance to debate the issue of debt collection letters in Parliament. Coming fresh off the back of last week’s Treasury Select Committee report -which backed our call for the government to put a stop to the threatening debt letters – this debate presented another crucial opportunity to demonstrate the level of political support for our campaign.

Led by our Advisory Board member Norman Lamb, the debate saw some valuable contributions from a number of MPs, highlighting the devastating impact these letters can have on people who are struggling with their finances or mental health. Even better, it brought a commitment from the Treasury Minister John Glen that he will explore ways to change the rules on the content of debt collection letters, to make them more supportive and less intimidating.

Getting our message across to government

Tuesday’s debate was first and foremost a valuable opportunity to tell the government why changes to the content of debt collection letters are so urgently needed. Citing our recent research on the links between suicide and financial difficulty, Norman Lamb highlighted the role that these letters can play in leaving people feeling hopeless, and unsure where to turn to for help:

“[These letters] are written in a way that can make people feel that there is no way out of their financial problems, sometimes leading to disastrous and fatal consequences… [They] often include complex text, which is capitalised and put in bold. The language can be intimidating to someone experiencing mental ill health.” – Norman Lamb MP

He also pointed out that current rules on the content of these letters require them to include out-of-date information on where people can get help. This is made worse by the fact that letters often feature threats of court action at the top, which leads people to miss information further down about seeking advice and support.

Laying out the solution

Yesterday’s debate was also a chance for MPs to clearly set out how this problem could be addressed. Currently, the content of debt collection letters for products like loans, overdrafts and credit and store cards is prescribed by the Consumer Credit Act, which was introduced nearly 45 years ago. By updating this legislation, and creating new rules requiring creditors to use easy-to-understand language in letters and to signpost people to sources of support, the government not only has an opportunity to help more people deal with their debt problems, but also to save lives.

The government is already in the process of looking at potential changes to the Act, following a recent review by the FCA. We know that wholesale reform of the Act to bring it all up to date and ensure it is providing effective protections for consumers is likely to be a complex and lengthy process. But as Norman explained to the Minister, there is also room to make targeted changes to the rules and regulations governing the content of debt collection letters more quickly – if the political will is there.

The government’s response

With the help of MPs like Norman, and the 9,000 people who’ve signed our petition and the 30 organisations who have backed our campaign, we have been working hard to get this issue firmly on the government’s agenda. And judging by the Minister’s statement yesterday, it looks like we’re succeeding.

Acknowledging the harm that the wording of debt collection letters can cause, John Glen told MPs that the issue will be at the “top of my list of priorities” when considering opportunities for reform. He went on to state that he would “carefully examine” the case for making targeted changes to rules on the content of these letters separately from a wider review of the Consumer Credit Act, to allow changes to be made more quickly, and committed to working with Norman to find a “timely and effective” solution.

This is a promising indication that the government understands the need to change the law on debt letters, and sees this as a pressing issue. However, as we await the government’s official response to the FCA review and the Treasury Select Committee report, it’s vital that we keep up the pressure on ministers to act. You can help us do this by adding your name to our petition and sharing it on social media.