Helen Undy, Head of External Affairs, Money and Mental Health

Fear and foul play

*TRIGGER WARNING* This blog contains information about bailiff action that some might find distressing.

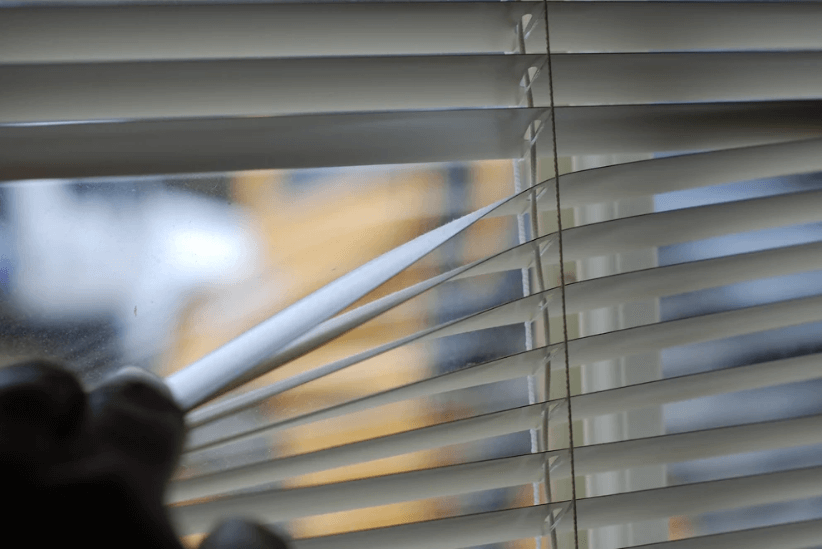

Imagine there’s a knock at your door at 6am tomorrow morning.

It wakes you up, you weren’t expecting any visitors – it would probably feel unsettling, stressful – you’d worry something was wrong. You’d feel undignified, hurrying to open the door in your pyjamas, half asleep.

Now imagine that when you open the door, it’s a bailiff.

They’ve come to take payment for a debt you haven’t managed to keep on top of. They say that if you haven’t got the money, they’re going to come in and take your things. You’d be upset, stressed, anxious. And those feelings wouldn’t just go away when the bailiff leaves. The next night you’d probably feel a bit less secure going to sleep, knocks at the door would be that bit more intimidating.

Now, finally, imagine that you’re already living with a mental health problem.

Perhaps you have anxiety that makes talking to strangers or letting them into your house extremely stressful. Perhaps you have severe depression and haven’t been opening the post, you’re feeling very low and didn’t realise the state your finances had got into. Or you’re feeling paranoid, you think people are coming to get you, that the phones might be tapped or you’re being watched. Imagine how you’d feel when you get the 6am knock at the door in that scenario. The long-term impact that it could have.

Sadly, for too many people this is not a thought-experiment – it happened today.

“Anytime there was a knock on the door I hid, usually on the floor. My heart pounds now still, at anyone at the door and I have developed a phobia of phones.”

The silent majority

Half of people in problem debt have mental health problems. And given those mental health problems can also make it harder to resolve the debt – to pick up the phone and speak to creditors, to earn the money to pay or to find the mental energy to put together a repayment plan – the prevalence amongst those people visited by bailiffs is likely to be even higher. Amongst StepChange Debt Charity clients contacted by a bailiff, 57% said they had depression and 66% stress or anxiety.

The primary responsibility for identifying that a customer is unwell and needs extra support should sit with the creditor. When making a decision to lend, chasing unpaid debts or handing a debt over to an enforcement agency, creditors should be trying to proactively identify customers in need of extra support. No one with a mental health problem should have their debt passed to a bailiff, and we believe that creditors should have robust processes in place to stop this happening.

But, important as this is, it won’t always work. Telling a bank, energy provider or HMRC about your mental health can be stressful, embarrassing – and sometimes practically impossible if you can’t use the phone. Some people entirely disengage from their finances for months at a time, not opening the post or emails. It’s very hard for a creditor to ascertain what’s going on these circumstances.

“It feels like an unbreakable cycle. You’re too scared to answer the phone or open letters. You feel embarrassed. And the situation feels like drowning.”

So, while creditors must aim to ‘screen out’ people with mental health problems before debts are passed to enforcement, this is not a ‘get-out-of-jail-free’ card for the bailiff industry to assume that mental health is not their issue. At the moment people visited by bailiffs are more likely than not to have a mental health problem; even with improved screening prevalence is likely to remain high.

Time for action

That’s why we’re calling for broad improvements to the way that bailiffs operate across the board. To limit the psychological harm caused, not just to people with mental health problems, but anyone who finds themselves being pursued by a bailiff. Being in financial difficulty can have an enormous impact on our mental health, and our research showed that one key contributing factor is the actions of creditors and bailiffs when collecting debts.

In 2014 the Government set out reforms to the bailiff industry, to tackle poor practice and protect people, like those with mental health problems, most at risk from harm. Sadly, recent evidence suggests that these reforms have had little impact. Debt charities like Citizens Advice, StepChange Debt Charity and the Money Advice Trust regularly hear of poor practice including bailiffs entering people’s homes before 6am or after 9pm, seizing possessions that belong to someone other that the person in debt, being aggressive or threatening, or even coming into the house when only children are at home.

Along with many other voices in the sector, we believe that fundamental reform of the bailiff industry is needed urgently, before more harm is caused. People who have experienced a financial crisis in the last six months are nearly eight times as likely to think about suicide; the consequences of that 6am knock at the door in these circumstances can be catastrophic.